Numbers

Lending Impact

Loan Portfolio

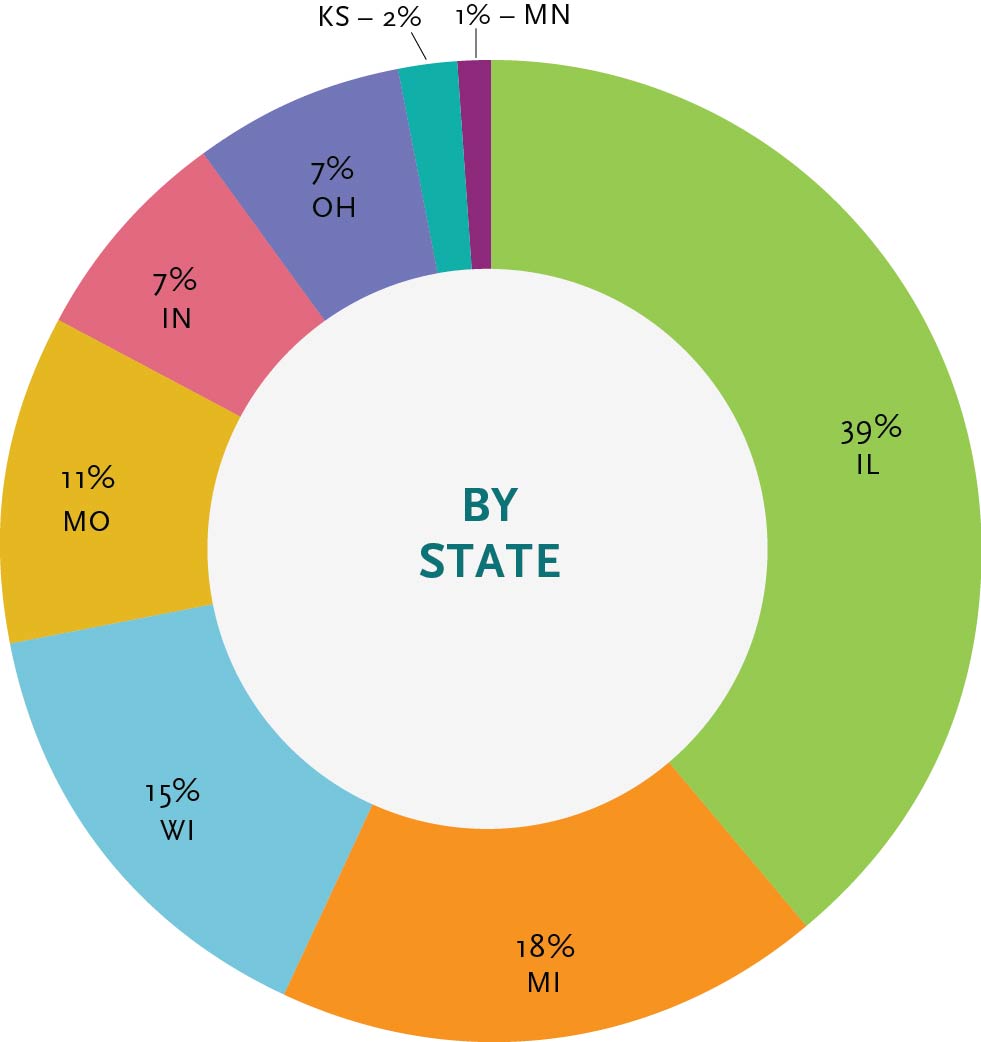

Loan Portfolio By State

A donut chart showing the distribution of IFF’s loan portfolio by state. Illinois makes up 39% of the loan portfolio followed by Michigan at 18%, Wisconsin at 15%, Missouri at 11%, Indiana at 7%, Ohio at 7%, Kansas at 2%, and Minnesota at 1%.

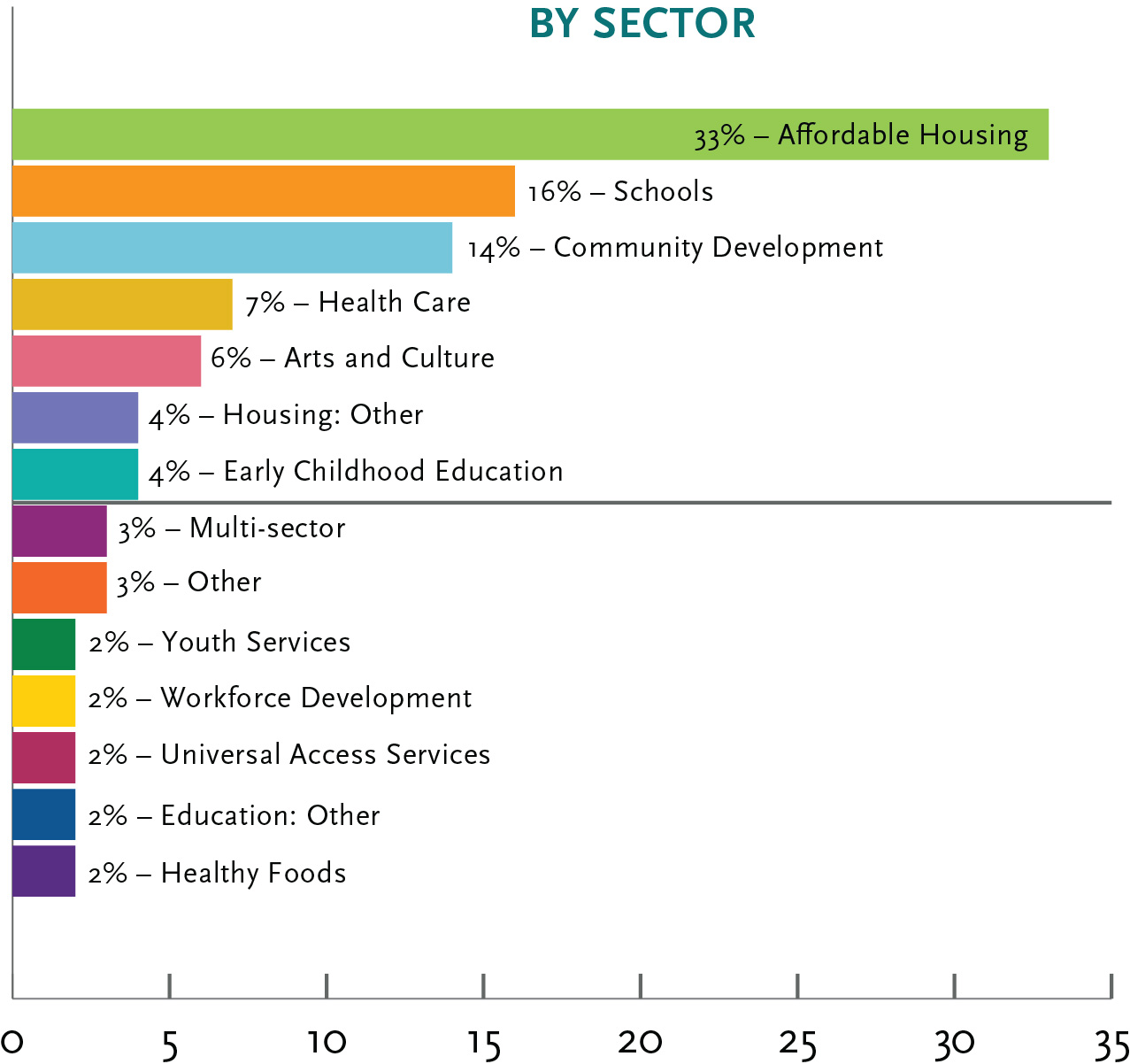

Loan Portfolio By Sector

A bar chart showing the distribution of IFF’s loan portfolio by sector. Affordable housing makes up 33% of the loan portfolio followed by schools at 16%; community development at 14%; health care at 7%; arts and culture at 6%; other housing and early childhood education at 4%; multi-sector and other each at 3%; and youth services, workforce development, universal access services, other education, and healthy foods each at 2%.

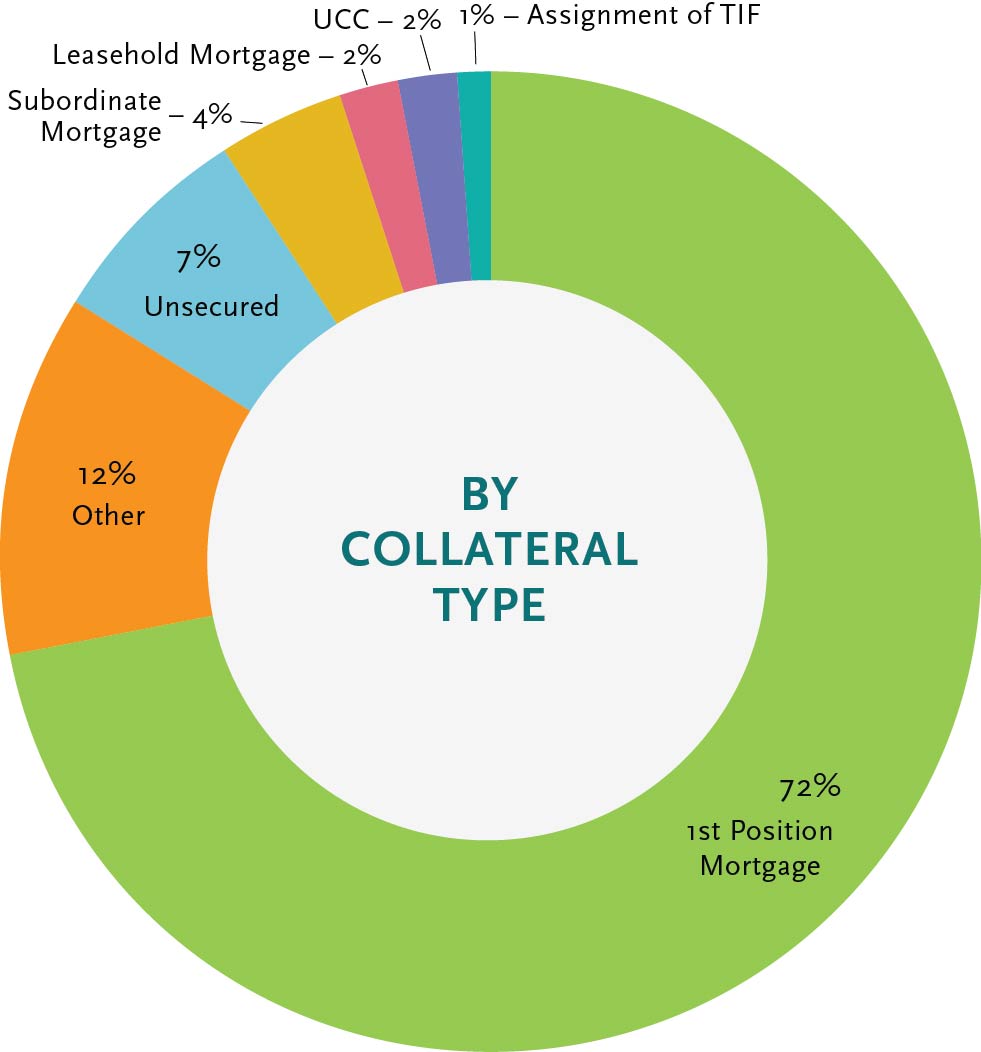

Loan Portfolio By Collateral Type

A donut chart showing the distribution of IFF’s loan portfolio by collateral type. First position mortgage makes up 72% of the loan portfolio followed by other at 12%, unsecured at 7%, subordinate mortgage at 4%, leasehold mortgage and UCC each at 2%, and assignment of TIF at 1%.

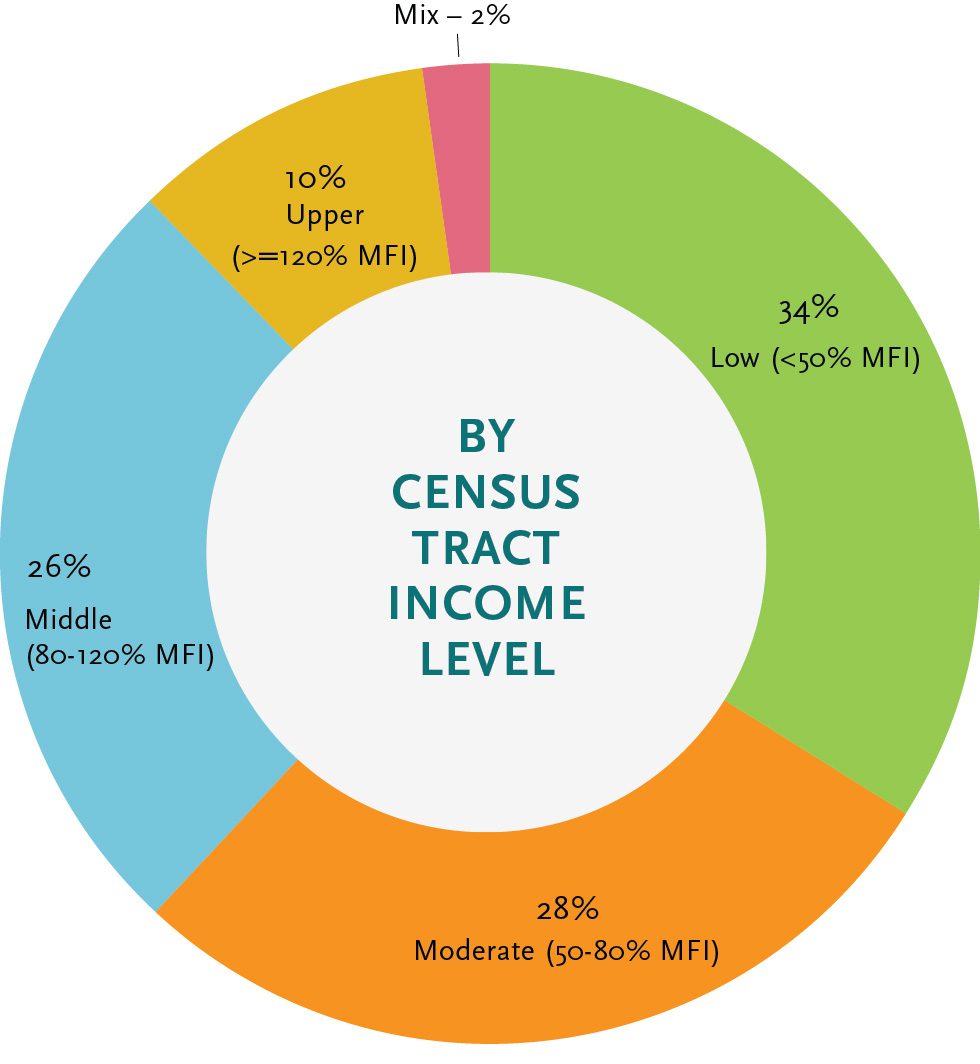

Data gathered by the U.S. Census and other federal agencies/programs – notably the Community Reinvestment Act, Housing and Urban Development, and Home Mortgage Disclosure Act – have transitioned to these new labels for income levels. While the labels have changed, the percentages based on Median Family Income (MFI) have remained the same; what were “very low” and “low” are now “low” and “moderate.”

Loan Portfolio By Census Tract Income Level

A donut chart showing the distribution of IFF’s loan portfolio by census tract income level. Low (less than 50% median family income) makes up 34% of the portfolio followed by moderate (between 50-80% of median family income) at 28%, middle (between 80-120% of median family income) at 26%, upper (greater than 120% median family income) at 10%, and mix at 2%.

Our commitment to supporting the full range of nonprofits across the Midwest provides our investors with a well-secured and diversified loan portfolio. These graphs reflect the percentage of dollars in IFF’s portfolio of loans — which, as of Dec. 31, 2024, included 748 loans totaling $618.5 million.

The above graphs include loans made under our New Markets Tax Credit (NMTC) Small Project Loan Pool, which brought the benefits of NMTC financing to smaller nonprofit projects throughout the Midwest.

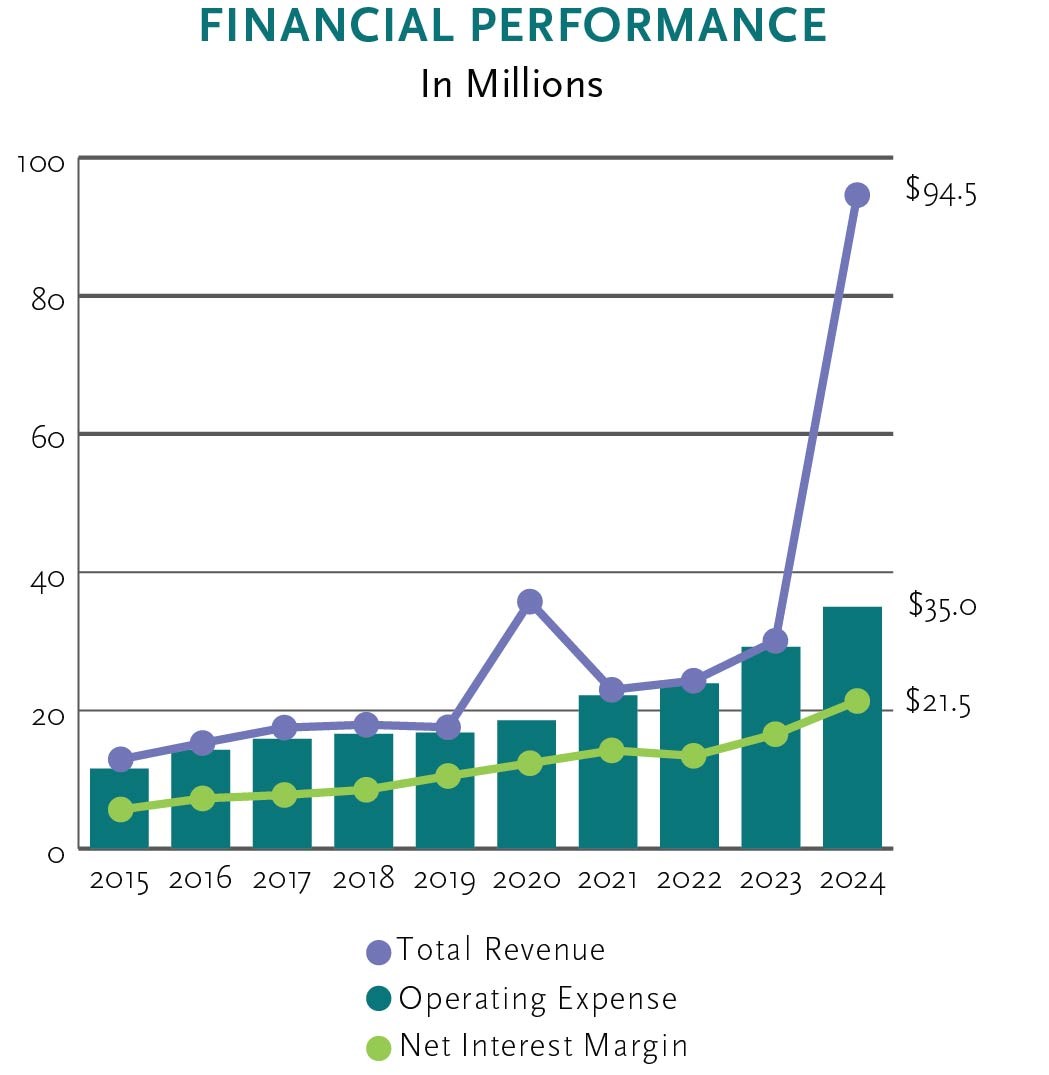

Financial Performance

Ensuring a financially strong IFF is key to maximizing our ability to best deliver on our mission. In 2024, IFF continued to maintain a strong track record of performance. Rated four-star, AAA+ from AERIS, IFF is one of a handful of CDFIs in the country to merit this top rating for both impact and financial condition.

The noticeable spike in our 2024 revenue is due to a one-time anonymous gift.

Financial Performance

A combined line chart and bar chart showing IFF’s financial performance over a 10-year period. Lines display the trends of Total Revenue and Net Interest Margin over time, and bars represent the Operating Expense for each year. In 2024, IFF’s total revenue was $94.5 million, operating expenses were $35 million, and net interest margin was $21.5 million.

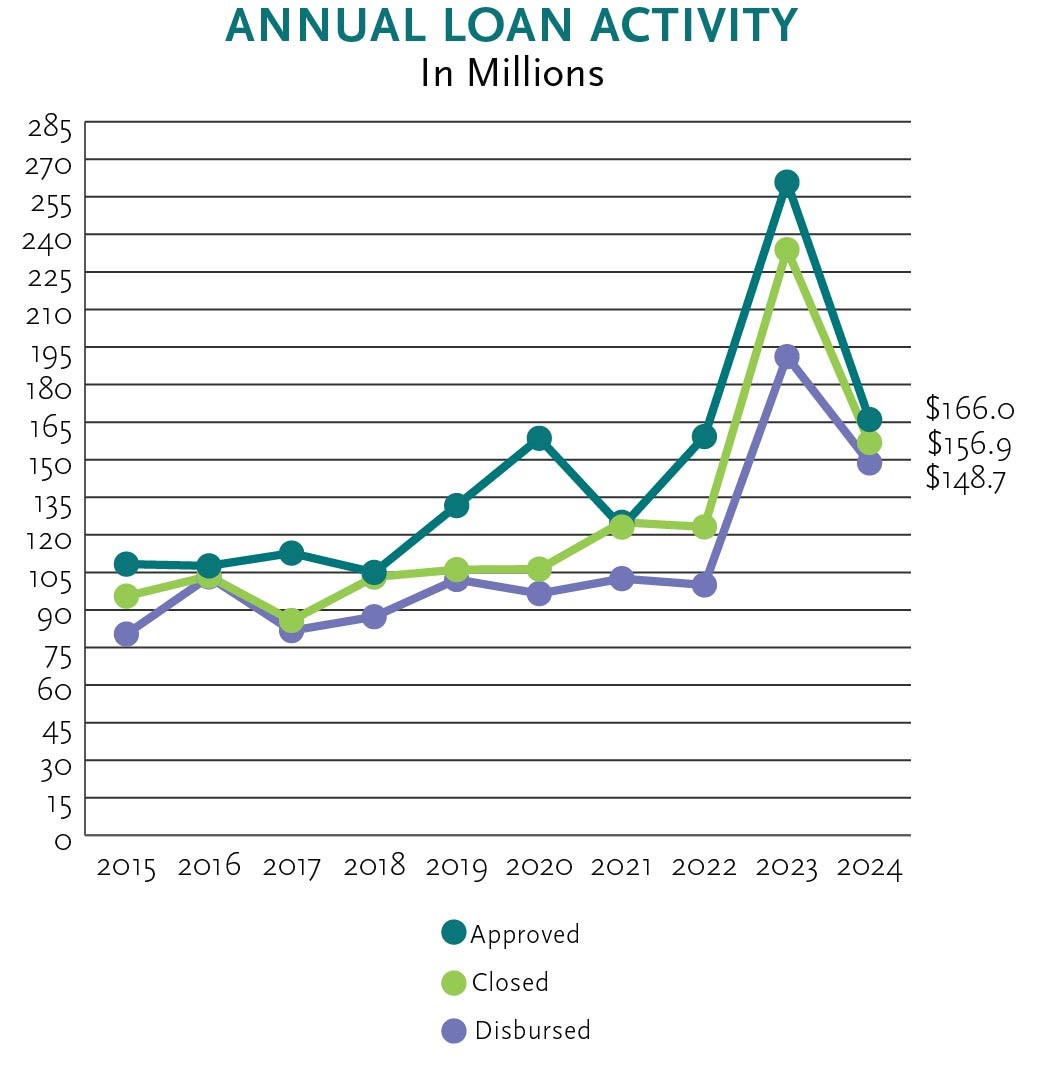

Annual Loan Activity

A line chart showing the trend of three different categories of annual loan activity (Approved, Closed, and Disbursed) over a 10-year period. In 2024, IFF’s approved loans totaled $166 million, closed loans totaled $156.9 million, and disbursed loans totaled $148.7 million.

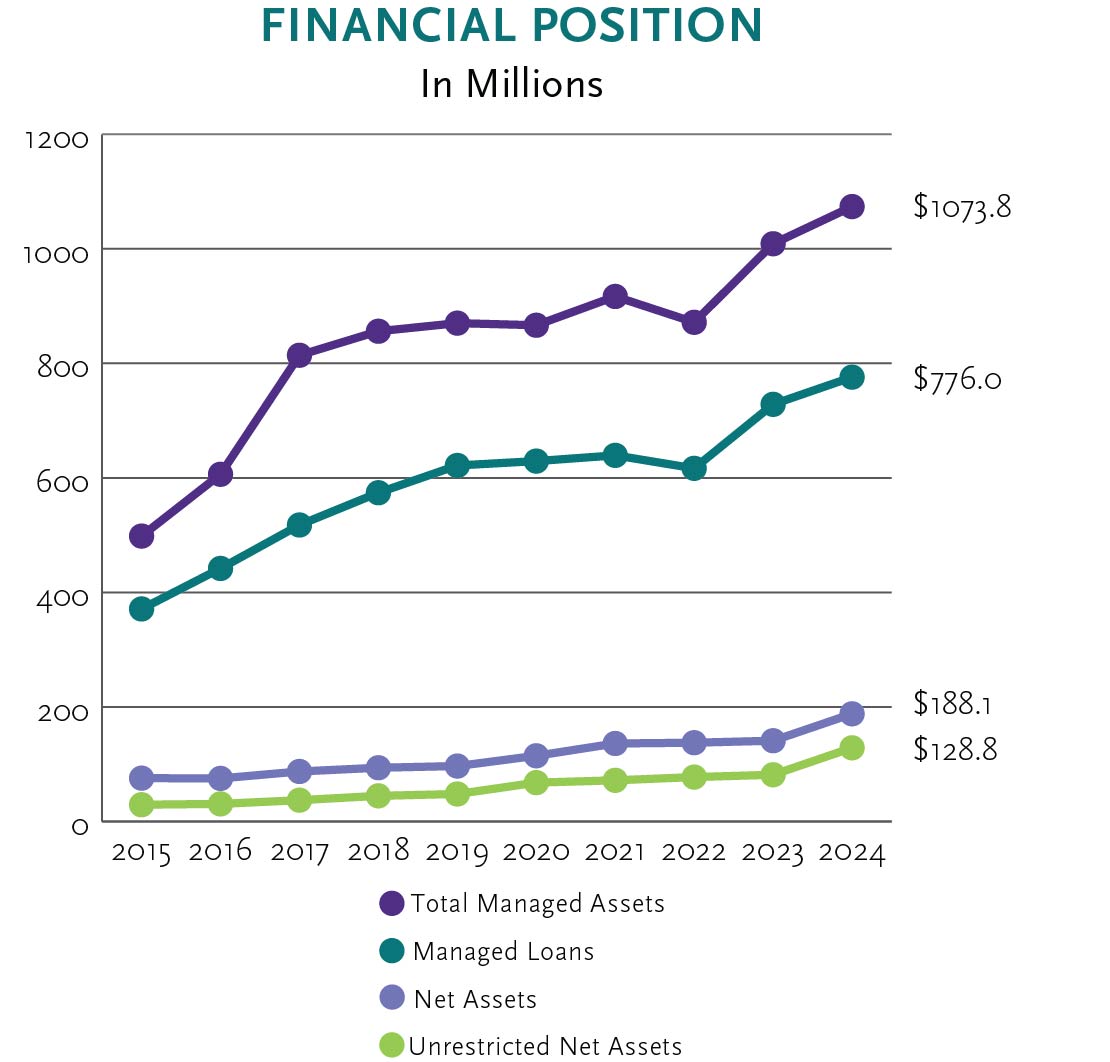

Financial Position

A line chart showing the trends of four different financial indicators (Total Managed Assets, Managed Loans, Net Assets, and Unrestricted Net Assets) over a 10-year period using distinct lines for each. In 2024, IFF’s total managed assets were at $1073.8 billion, managed loans were at $776 million, net assets were at $188.1 million, and unrestricted net assets were at $128.8 million.

Delinquency and Loan Loss History

A combined line chart and bar chart showing the percent of delinquency and loan loss history of IFF’s portfolio over a 10-year period. Lines display the trends of net loan losses and two different bars display the trends of delinquencies (60+ days) and loan loss reserves. In 2024, IFF’s delinquencies were at 2.41%, net loan losses were at .34%, and loan loss reserves were at 4.73%

Managed Assets

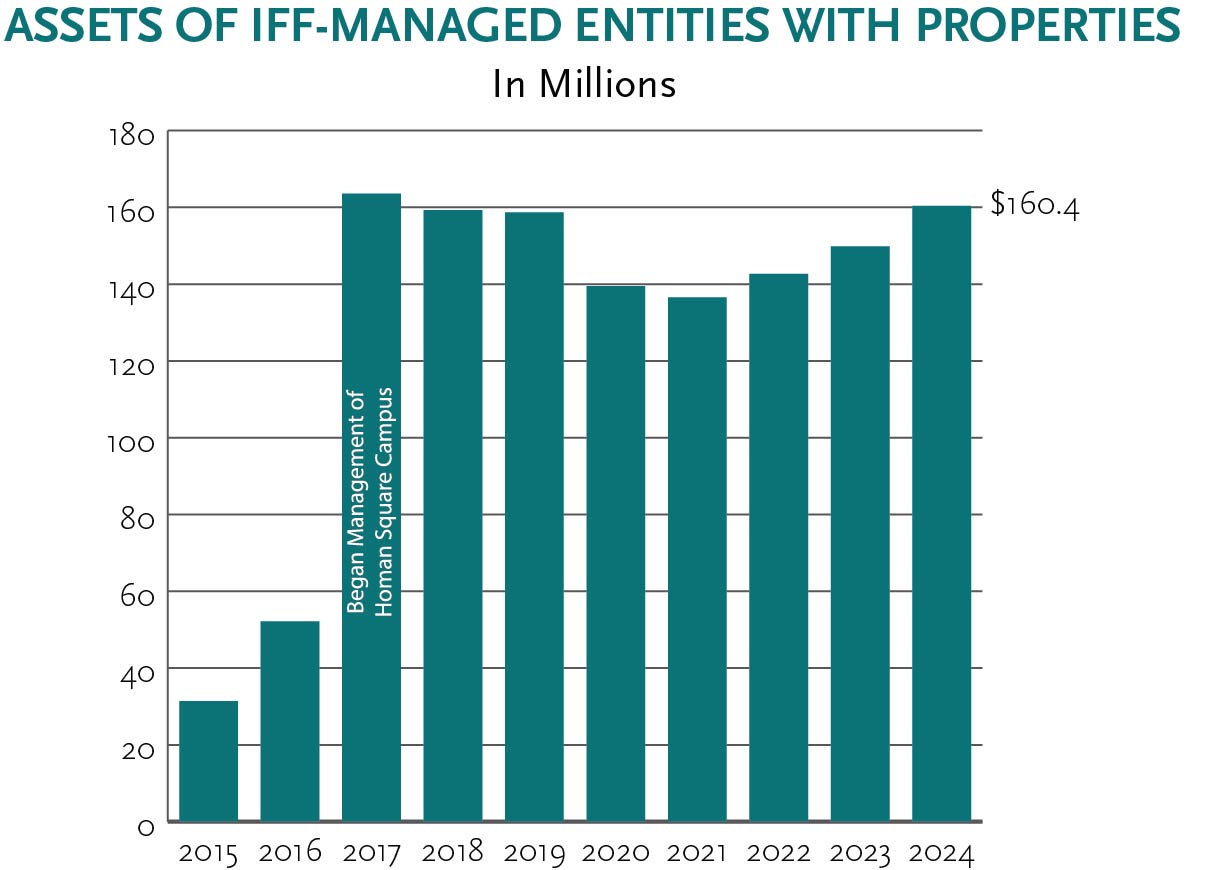

Strong nonprofits are essential to strong communities, and the ability of nonprofits to own their facilities is a key part of that equation. Most of the time, that’s where we start — our lending and consulting tools are designed to support nonprofits ready to own facilities.

Sometimes, IFF will temporarily own facilities during a predevelopment or construction phase as permanent financing is acquired — or, a bit longer as operations stabilize — before transferring them back to local hands. Other times, and always at the direction of the community, IFF acts as a permanent, long-term owner where no other potential owner is present or ready, but the community demand for the facility is strong.

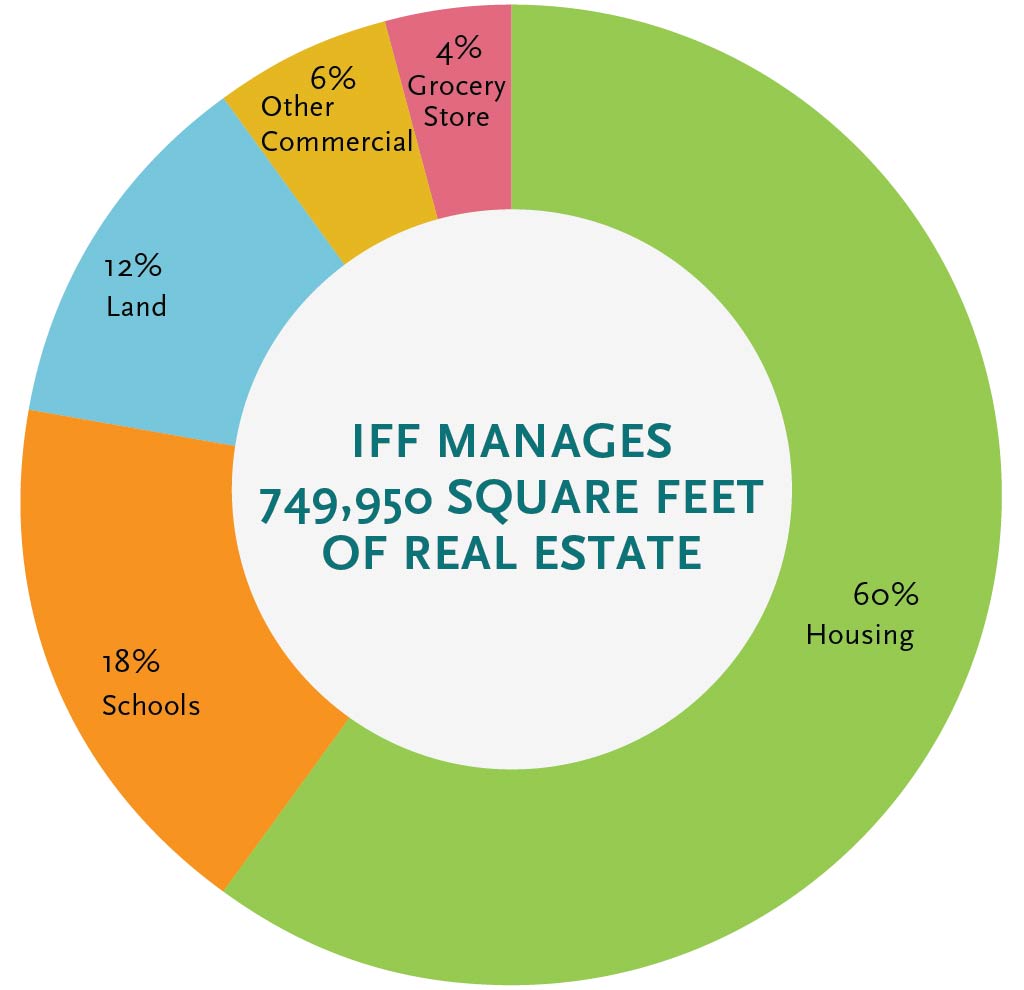

IFF now owns and/or manages three-quarters of a million square feet of real estate across our footprint.

Assets of IFF-Managed Entities with Properties

A bar chart showing the value of assets of IFF-managed entities with properties over a 10-year period. In 2024, IFF’s assets were at $160.4 million.

IFF Manages 749,950 Square Feet of Real Estate

A donut chart showing the distribution by categories of the 749,950 square feet of real estate that IFF manages. 60% is in housing, 18% is schools, 12% is land, 6% is other commercial, and 4% is grocery stores.

Community Development Solutions and Home First

IFF serves as a real estate developer to launch community-driven projects. We work closely with community development partners to identify gaps where impactful projects would not happen through traditional development avenues. In 2024, driven by our equitable community development principles, IFF completed eight project milestones and had five projects under development, representing a total of over 166,962 square feet and more than $87.6 million in value.