From Joe Neri and the Board of Directors

Every day, IFF champions nonprofits to shape more equitable and vibrant communities. We believe nonprofits are the engine of social change and they deserve inspiring, high-quality spaces that amplify the impact of their work and serve as beacons of hope to their communities.

To achieve this, in 2022, IFF continued to provide essential supports to nonprofit changemakers through its community-centered lending, development, and real estate consulting, while also expanding and deepening our presence throughout the Midwest. Our research, data, and sector expertise – coupled with our commitment to equity, diversity, and inclusion – strengthened our ability to leverage our tools, broaden our partnerships, and further scale our impact. Highlights from the year include:

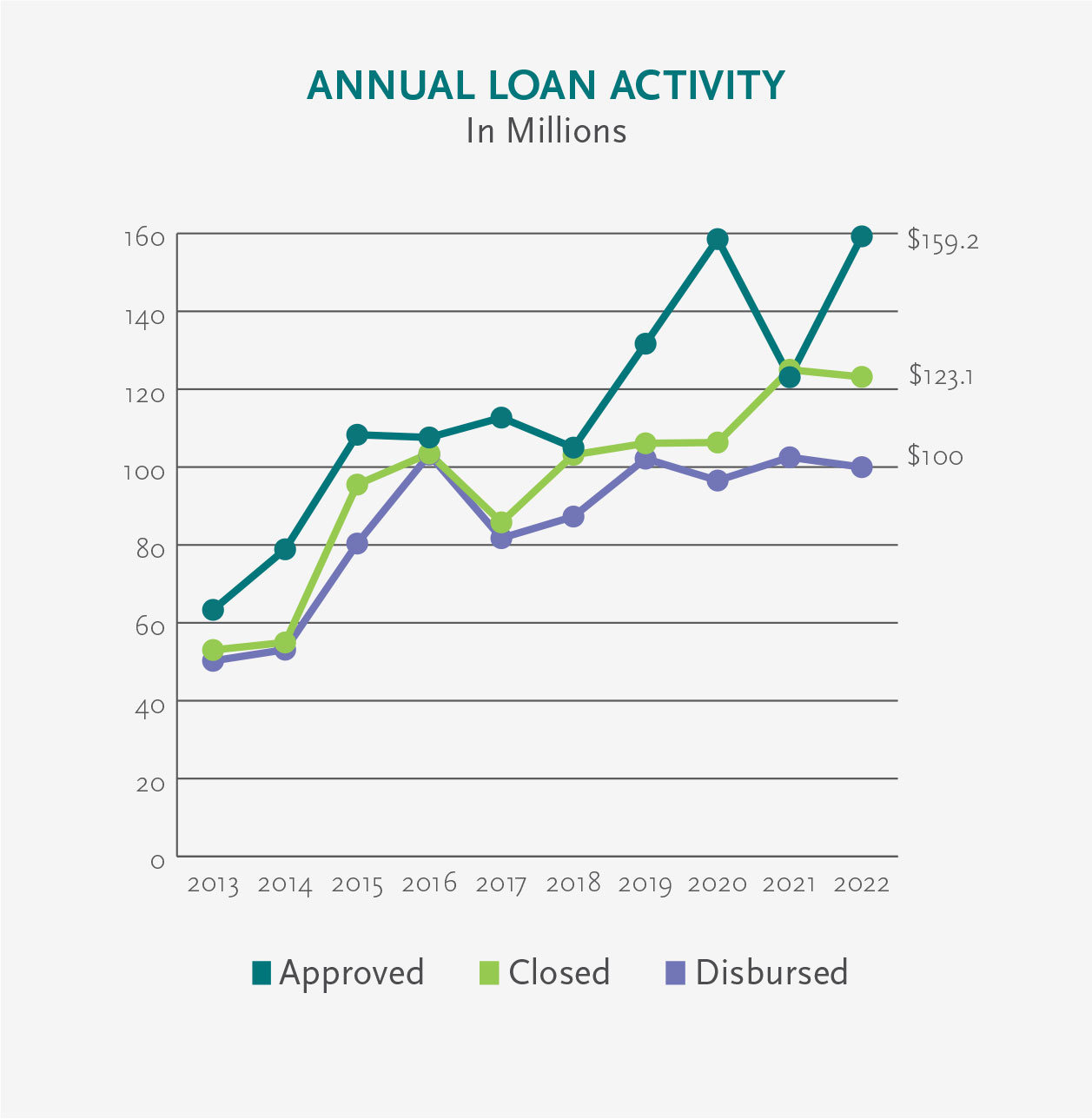

- Closing on $123.2 million in loans to more than 80 nonprofits and leveraging an additional $495.6 million in public and private investment;

- Completing the first phase of a new, $40 million, state-of-the-art middle school in North Chicago, IL, that realized the visions of students, teachers, and community members alike;

- Consulting on 77 nonprofit facilities projects, including managing the construction of over 102,000 square feet of real estate; and

- Partnering with the State of Michigan to launch the $50 million Caring for MI Future: Facilities Improvement Fund to support new and expanding early child care facilities.

This past year also afforded IFF the opportunity to reflect on our previous strategic plan and define a new vision for the future, recognizing how well our 2018-2022 strategic plan positioned us to help nonprofits and their communities respond to and recover from the pandemic – and, ultimately, rebuild more equitably for the long term.

Unlike traditional five-year strategic plans of the past, our current plan focuses on shorter term goals for the next three years. This approach reflects both the ambition and relevancy of our prior plan, as well as our aim to build upon key goals left unfinished due to the pandemic.

Our new plan continues IFF’s all-in commitment to advance social impact through our full suite of tools. We’ve identified five interconnected strategic pillars that sustain the spirit of our previous plan yet focus us on a bold, fresh set of priorities for the near term: building the staff and culture we need to better serve and be more accountable to our communities; making more loans to more nonprofits; fine tuning the model for our real estate consulting, making it even more impactful; delivering on the promise of IFF’s Social Impact Accelerator; and fully engaging with our investors and funders – all of you – to increase our collective impact across the Midwest.

While we are just getting started, in 2022 we made big strides in advancing this vision by providing:

- More capital for more changemakers. Every loan we make to a nonprofit has ripple effects across its broader community. In 2022, we approved a record $157.4 million in loans; reached deeper into Chicago’s neighborhoods; opened an office in Grand Rapids to serve Western Michigan; and expanded our reach in Indiana. And in 2023, we will add a new office in Cleveland, OH, as well.

- More problem-solving for system-level challenges. Providing more capital and putting our tools in the service of more changemakers grounds us in the communities we serve and opens the door to build the partnerships we need to deepen our impact. In 2022, we celebrated the 10-year anniversary of Home First, IFF’s in-house development group that prioritizes affordable, accessible, and community-integrated housing for people with disabilities. Since its launch, Home First has completed nine projects at distinct sites across Illinois.

- More investment impact across the Midwest. From working locally with individual and groups of nonprofits in communities, to whole sectors across a state, our local presence makes us an effective intermediary for impact capital and implementing local and regional solutions. In 2022, we deepened our partnerships with health care systems, corporations, and state and local government.

It’s an exciting time at IFF. With your support and partnership, we are continuing to build and grow our platform of finance, real estate, and development tools to invest in and support nonprofits and the communities they serve. Thanks to each and every one of you for helping us to bring our ambitious vision to life.

Together, we are building a stronger Midwest.

Joe Neri

Joe NeriChief Executive Officer

Cheryl Wilson

Cheryl WilsonBoard Chair

Stories

“What we want is our kids to attend a school that feels just as privileged as the best schools in the country. One important piece of that is having a facility that communicates to our children and our families the immense value that they have and the potential that exists in each of them.”

IFF's Strategic Vision 2022-2025

Our strategic vision for 2022-2025 doubles down on our longstanding commitment to strengthen nonprofits across the Midwest by focusing our efforts on five interconnected strategic pillars.

These five pillars were identified in service to IFF’s mission and vision, and will guide our work and decisions over the next three years. Here we share a bit more about each of our pillars and examples of how we began bringing them to life in 2022.

To read our 2022-2025 Strategic Vision, visit iff.org.

IFF's Mission

IFF strengthens nonprofits and the communities they serve by providing leadership, capital, and real estate solutions.

Building a One IFF culture.

Working together in a customer-centered way that leverages the deep knowledge and experience of the IFF team enables us to maximize resources in service to Midwest communities, while building a dynamic learning organization.

In continuing to build our One IFF culture, we are better equipped to respond to customer needs with flexibility, cross-functional perspecitve, and broad expertise and experience. We are also able to streamline our work and focus our time and energy on the unique problems we can solve.

Providing more loans to more nonprofits.

Making more loans to more nonprofits enables us to put capital into the hands of more changemakers so they can broaden their impact in more communities. We aim to better serve our customers by centering their needs, while we grow our balance sheet and create scale to support enterprise priorities, increase financial flexibility, create new tools, and ultimately drive systemic change.

Across the Midwest, we’re deepening our presence in under-tapped geographies, including providing loans in rural communities. In 2022, IFF made first-time loans in Springville, IN; Axtell, KS; and Hartland, MI.

Achieving a sustainable real estate consulting model.

Refining and operating a sustainable and high-impact model for real estate consulting enables us to consistently serve our customers with knowledge and expertise. We aim to be nimbler and more responsive, while also attracting top talent across the region.

By integrating the business model with our other services, we can magnify impact. For example, in Detroit, we provided real estate services and capital to the James and Grace Lee Boggs School (JGLBS), enabling the school to acquire and renovate its permanent facility, doubling its space and providing it new opportunities.

Realigning and resourcing our Social Impact Accelerator.

Realigning and resourcing the Social Impact Accelerator (SIA) enables us to more effectively leverage our knowledge, expertise, and experience in service to our customers, while advancing equity and systems change through more intentional innovation.

By deepening investment in SIA, we can model data-informed, equitable, co-creative practices, such as the launch of our 2022 Thriving Spaces Milwaukee early childhood facilities enhancement program based in high-need neighborhoods. The program was informed by IFF research and is part of a broader community partnership to invest in early childhood education (ECE).

Deepening our impact and presence across the Midwest.

Expanding our impact throughout the Midwest enables us to become the region’s intermediary for impact capital and reach more nonprofits. We can position IFF with government policy makers and other stakeholders to provide statewide solutions and reach smaller communities.

For example, in Michigan we are investing in building economies of scale by deepening our presence throughout the state, including administering a $50 million initiative to help new and expanding ECE providers through the Caring for MI Future: Facilities Improvement Fund.

Data

“It’s incredible the amount of expertise you need to understand and leverage them due to their complexity, but IFF was amazing to work with and really stepped up for us to make the project possible. Because of that, we’ll have this new community space that belongs to Central Ohio.”

Lending Highlights

As IFF has grown, so too has the average size of our loans – but providing small loans to nonprofits with big visions remains an indispensable component in our continuum for social impact.

89

Loans Closed

$123.2M

Dollars of Loans Closed

$495.6M

Capital Leverage

84

Nonprofits Served

2.5 M SF

Real Estate Developed

Impact Numbers

When nonprofits have access to flexible financing designed with their needs in mind, they can create safe, inspiring facilities to support their clients and strengthen their communities.

1,341

Students Seated

236

Child Care Slots

1,368

Housing Units Created/Preserved

109,710

New Patient Visits

Loan Portfolio

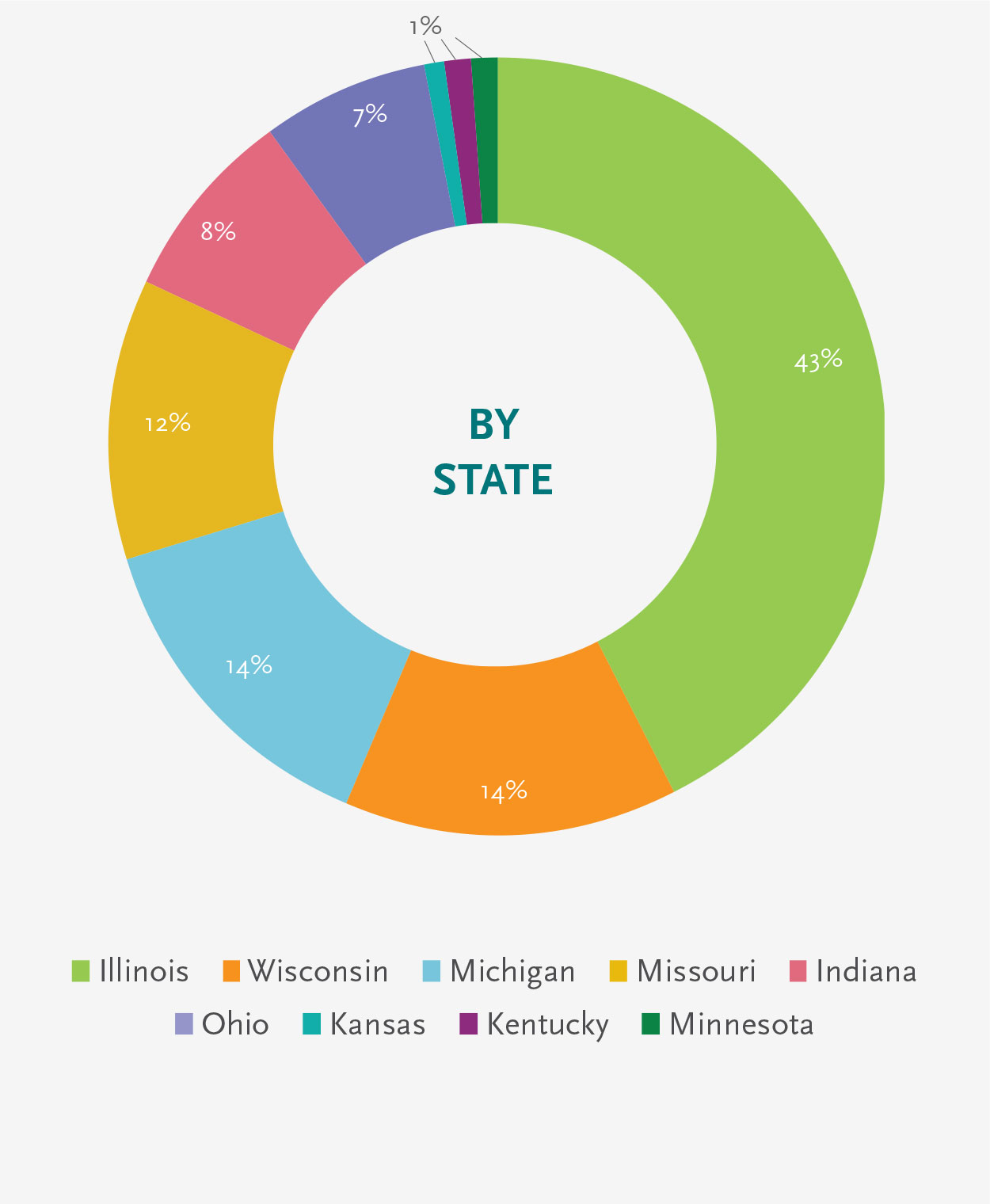

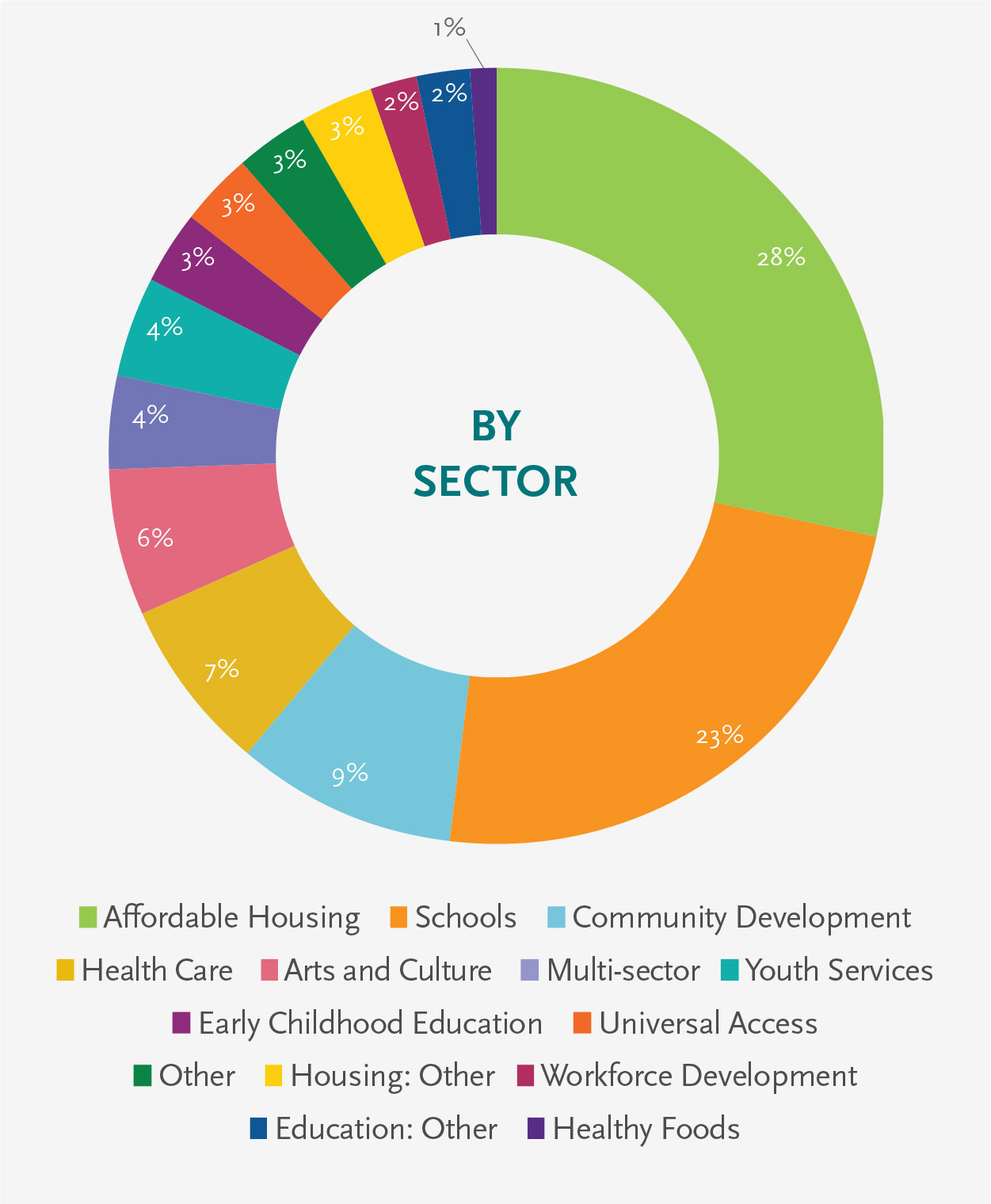

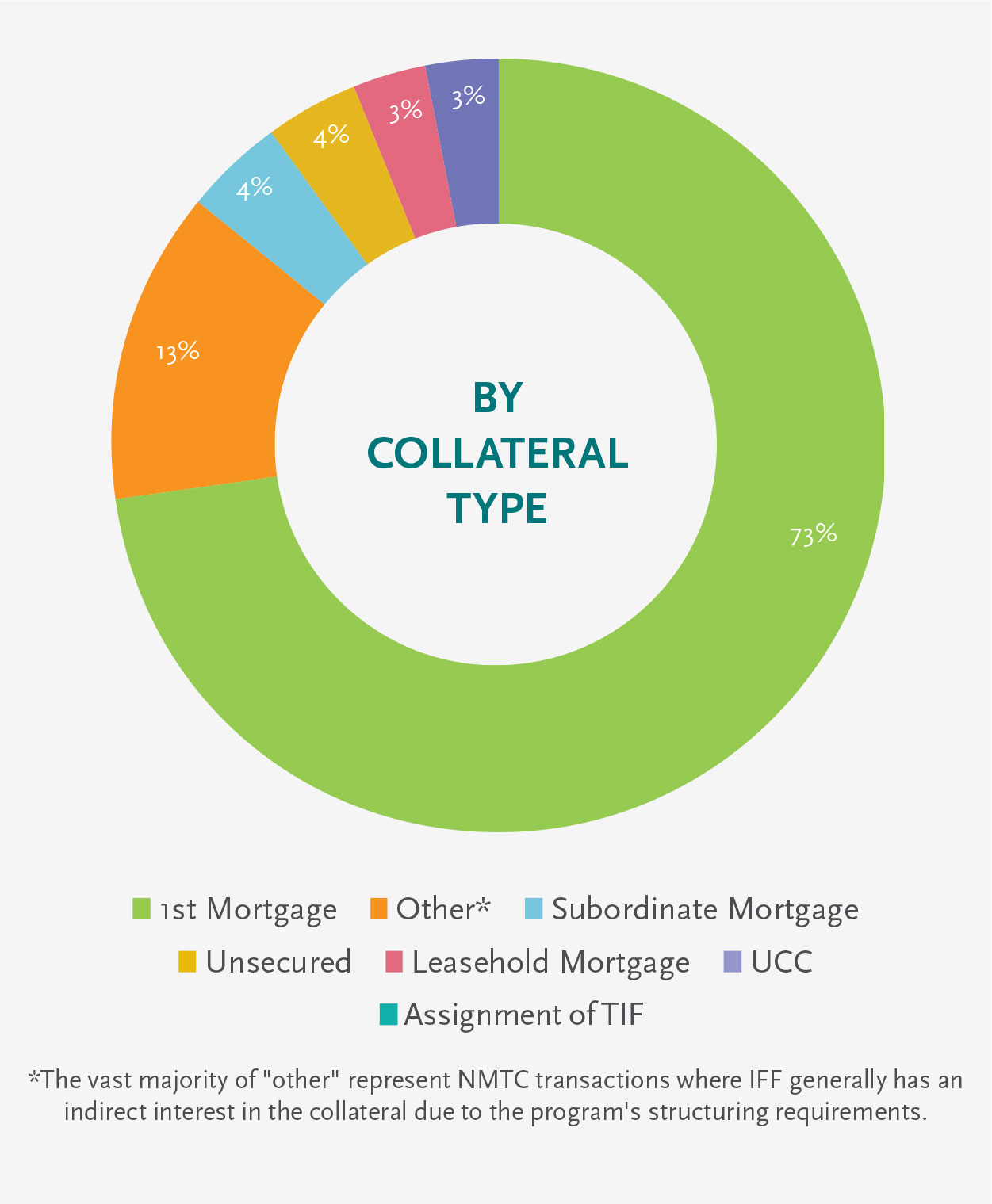

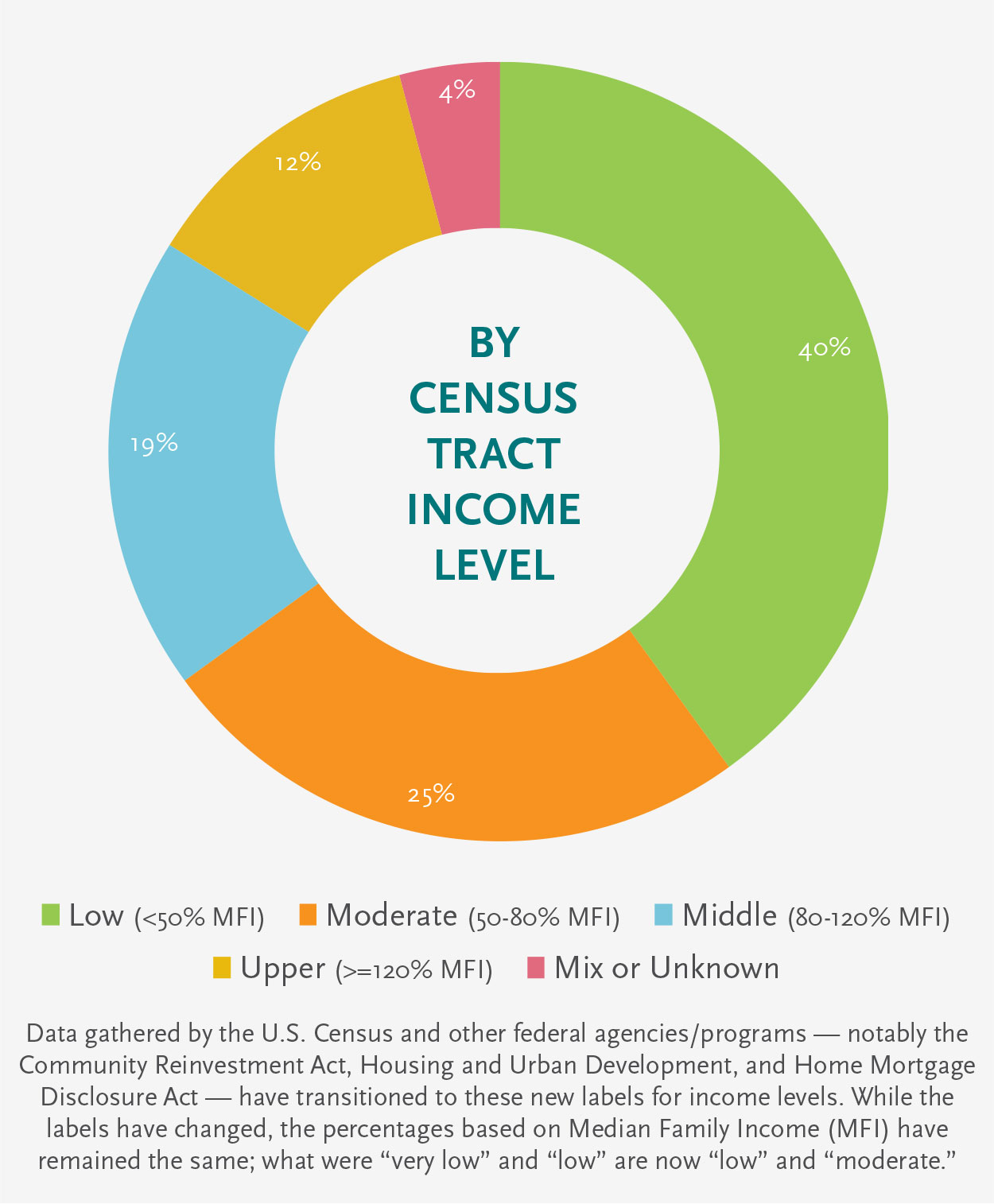

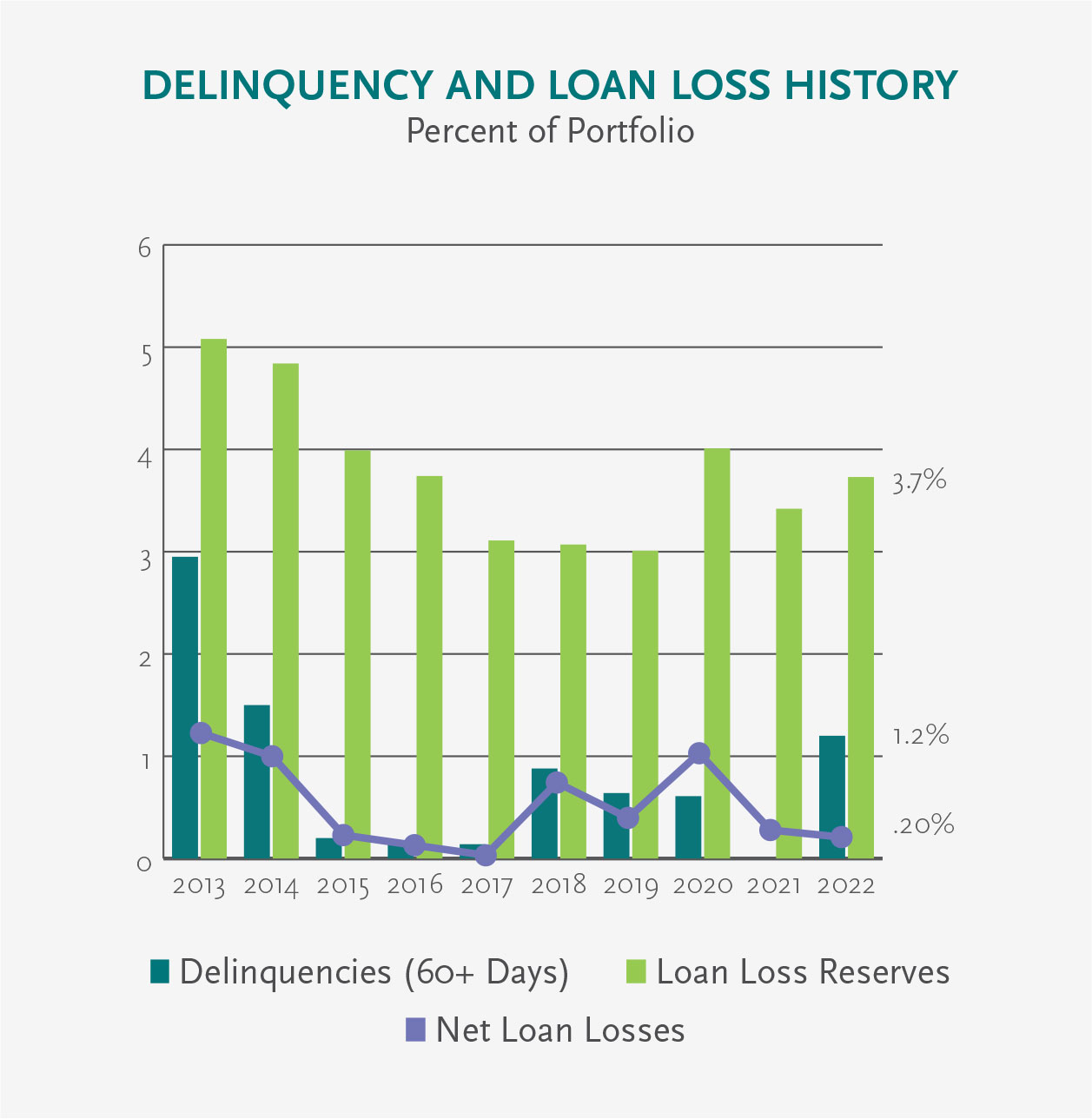

Our commitment to supporting the full range of nonprofits across the Midwest provides our investors with a well-secured and diversified loan portfolio. These graphs reflect the percent of dollars in IFF’s portfolio of loans — which, as of Dec. 31, 2022, included 655 loans totaling $448.2 million.

Included in the figures above and below are loans made under our innovative New Markets Tax Credit (NMTC) Small Project Loan Pool, which brings the benefits of NMTC financing — low rates and seven-year, interest-only payments — to smaller nonprofit projects throughout the Midwest.

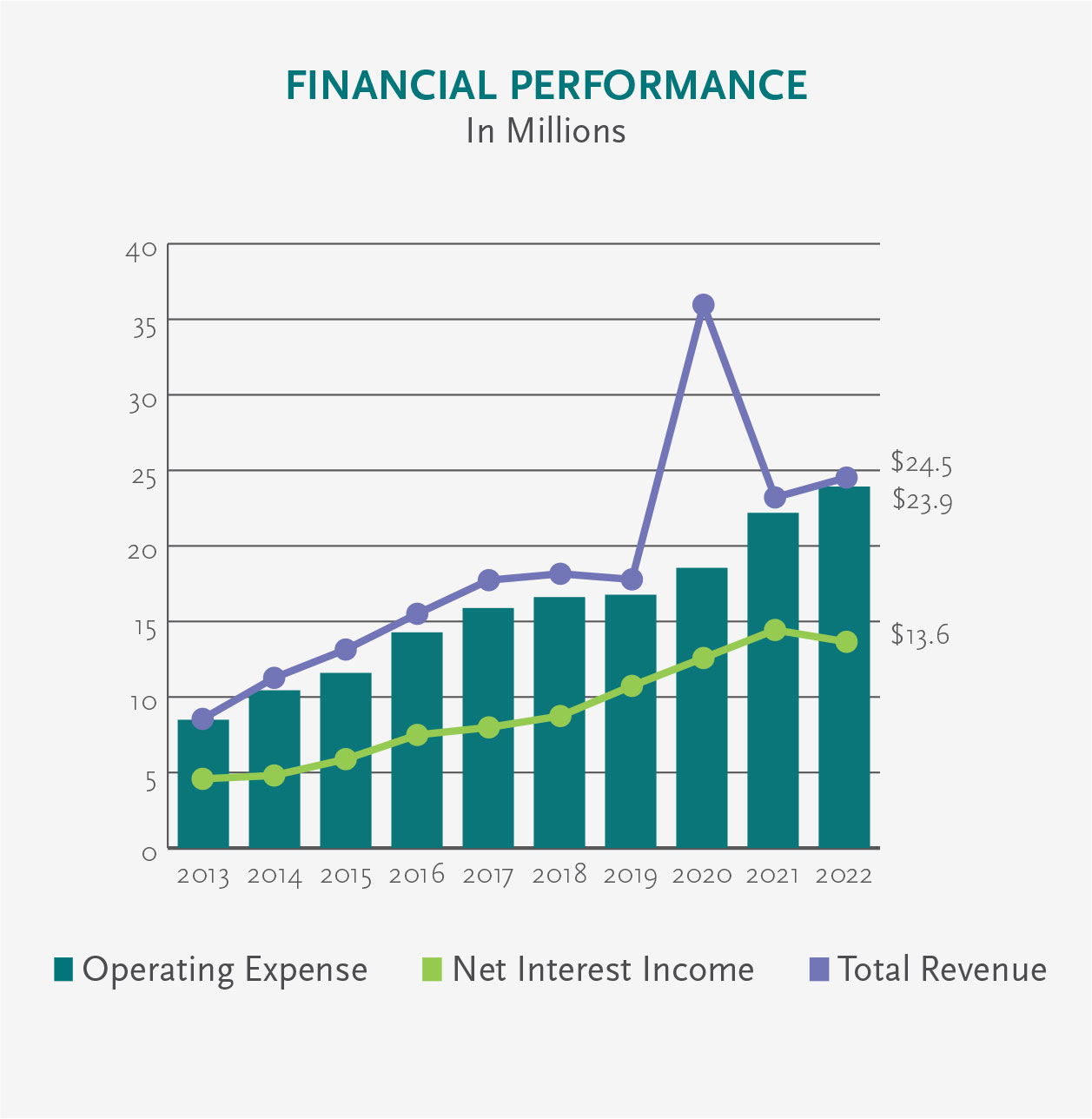

Financial Performance

Ensuring a financially strong IFF is key to maximizing our ability to best deliver on our mission. In 2022, IFF continued to maintain a strong track record of performance. Rated four-star, AAA+ from AERIS, positioning IFF as one of the handful of CDFIs in the country to merit this top rating for both impact and financial condition.

The noticeable spike in our revenues in 2020 was due to a one-time major gift of $15 million from philanthropist MacKenzie Scott in December 2020. IFF was one of the many nonprofits to receive such a significant gift after a rigorous, data-driven vetting process that identified organizations with strong leadership teams, clear track records of results, and a focus on communities facing challenges related to food insecurity, racial inequity, poverty, and low access to capital.

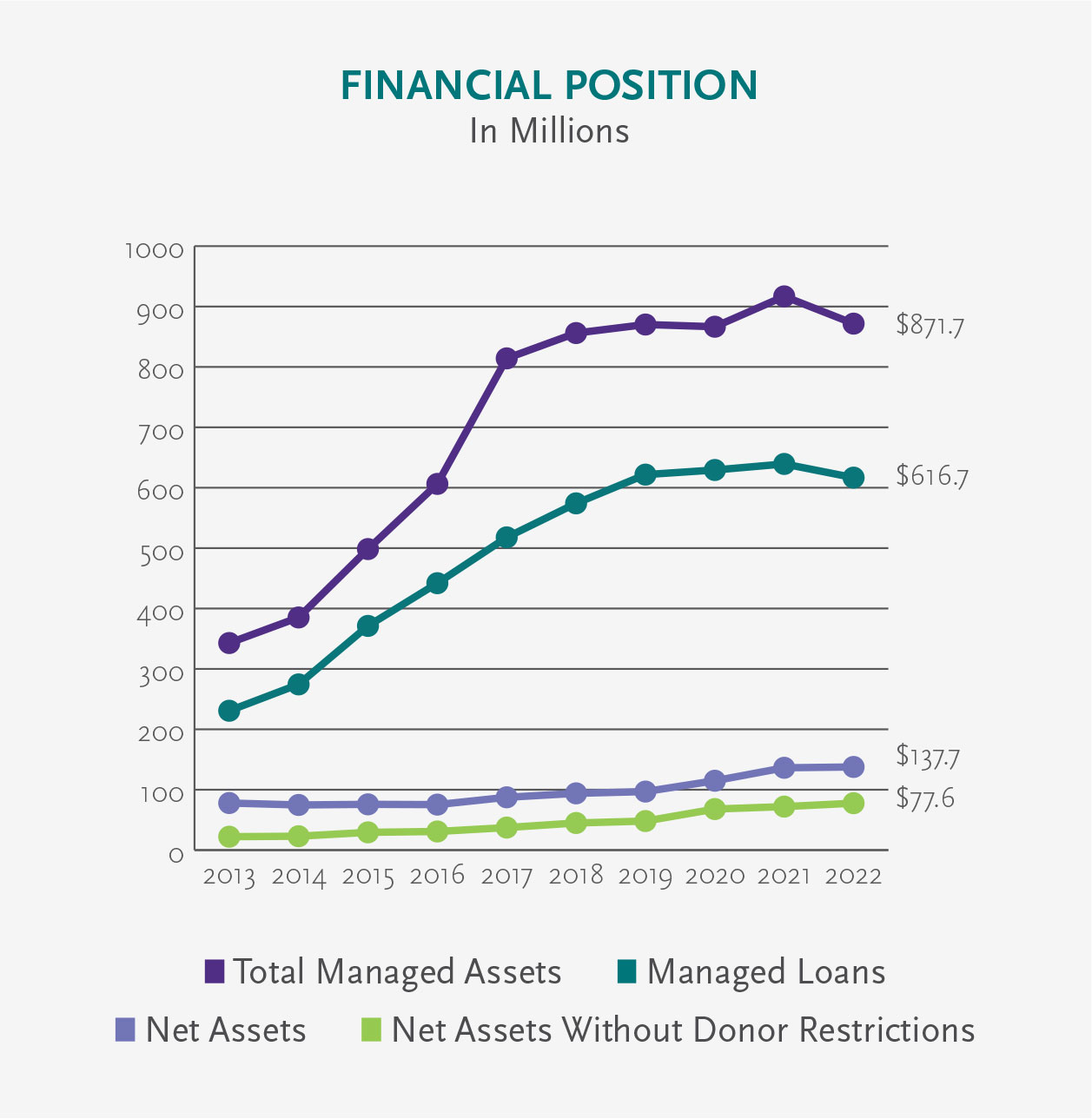

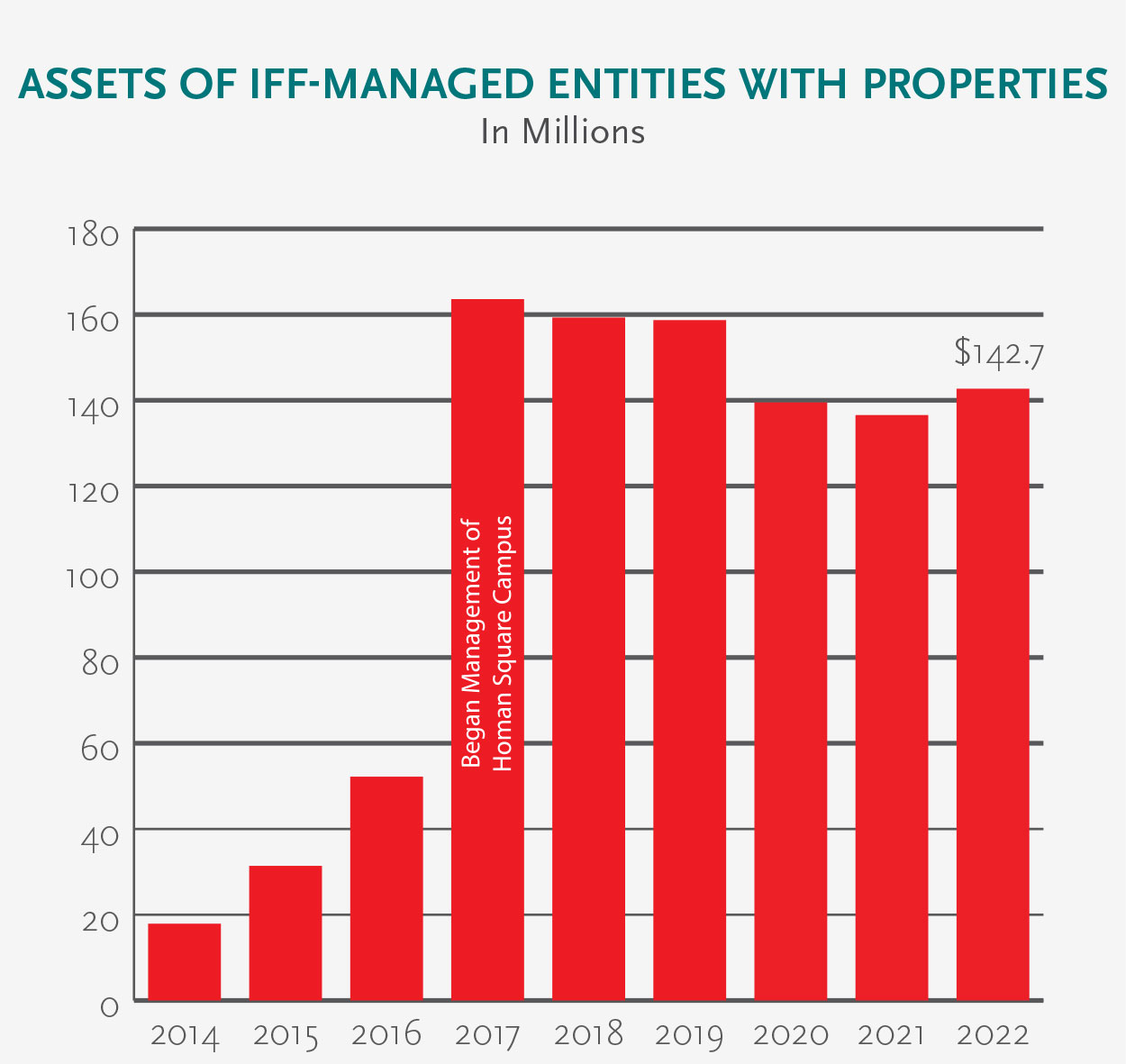

All charts reflect financial information for IFF standalone as of Dec. 31, 2022. The only exception is for Managed Assets and Managed Loans, which include the Assets/Loans that are managed by IFF but legally owned by its programmatic subsidiaries, NMTC-related entities, Hope Starts Here, and the Foundation for Homan Square. IFF consolidated financial information is available at iff.org.

Managed Assets: Entities with Real Estate

Strong nonprofits are essential to strong communities, and the ability of nonprofits to own their facilities is a key part of that equation. Most of the time, that’s where we start — our lending and consulting tools are designed to support nonprofits ready to own facilities.

Sometimes, IFF will temporarily own facilities during a pre-development or construction phase as permanent financing is acquired — or, a bit longer as operations stabilize — before transferring them back to local hands. Other times, and always at the direction of the community, IFF acts as a permanent, long-term owner where no other potential owner is present or ready, but the community demand for the facility is strong.

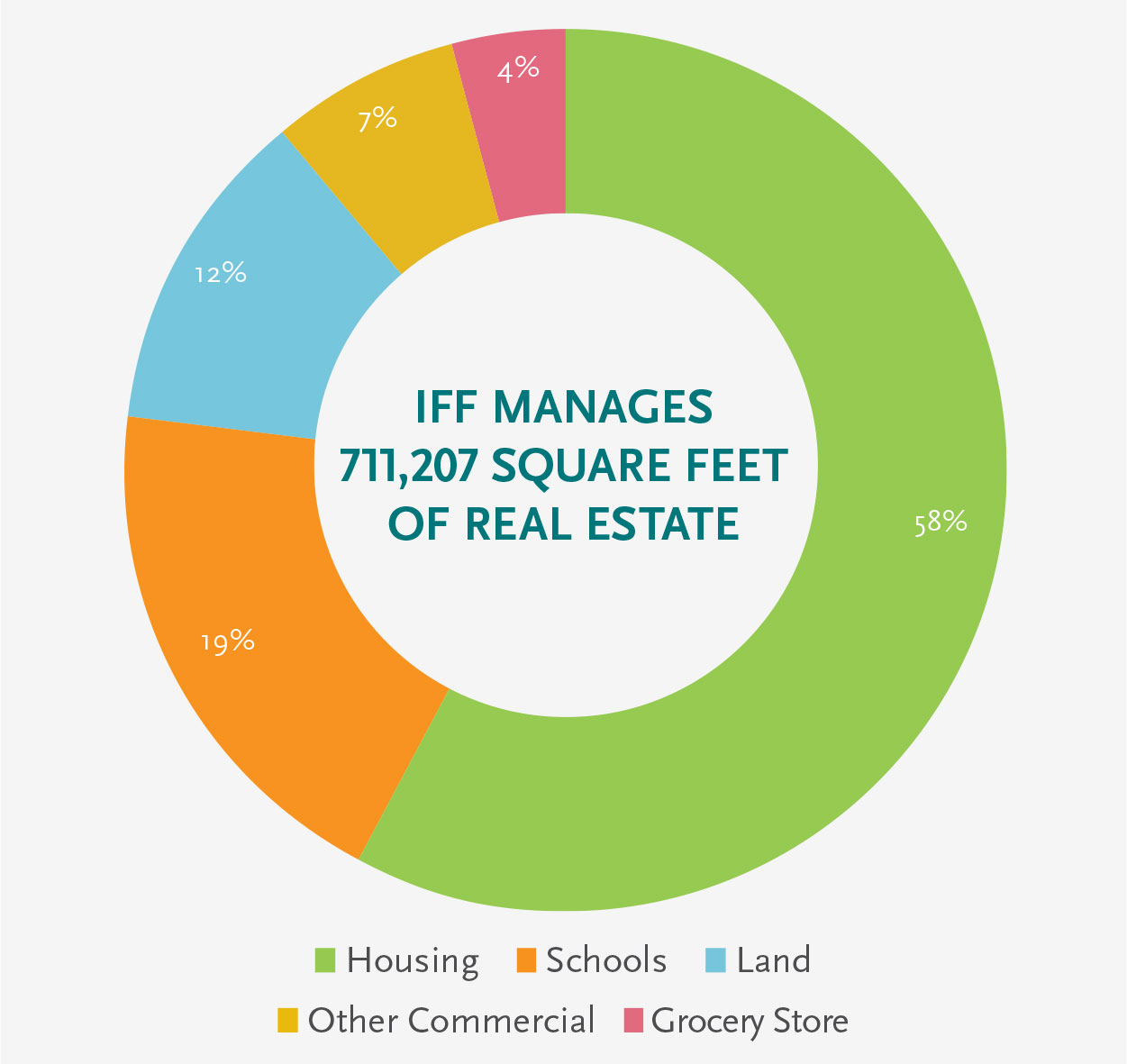

IFF now owns and/or manages nearly three-quarters of a million square feet of real estate across our footprint.

Community Development Solutions & Home First

IFF serves as a real estate developer to launch community-driven projects. We work closely with community development partners to identify gaps where impactful projects would not happen through traditional development avenues. In 2022, driven by our equitable community development principles, IFF completed one project and had 21 projects under development, representing a total of over 358,842 square feet and more than $234.5 million in value.

1

Number of Projects

$45.1 M

Total Value of Projects

97,470

Total Square Feet of Projects

243

Number of Housing Units Under Development

Places

“The program and services in the AMPED Innovation Center are going to help the community heal, learn, and grow. But the building itself is also important because it’s going to be a shining star right on the ninth street division that brings hope to the community, demonstrates that this what we deserve in the west end, and shows what we can do.”

Explore States

Click on a map to learn more about our lending, consulting, special programs and clients in each state.

Indiana

IFF offers both lending and real estate consulting services in Indiana, with our Chicago staff serving Northwest Indiana and our Indianapolis office serving the remainder of the state.

Lending

7 loans totaling $3.6 M

DetailsConsulting

13 real estate projects executed

Special Programs

Client Spotlights

Kheprw Institute

Founded in 2003, Kheprw Institute works to create a more equitable, human-centered world by nurturing young people to be leaders, critical thinkers, and doers. With the help of a $210,000 IFF loan and support from IFF’s Stronger Nonprofits Initiative, the Indianapolis-based organization purchased a 17.5-acre farm to bolster its Urban Agriculture Initiative.

Photo: Kheprw Institute community garden. Photo courtesy of Kheprw Institute.

Energy Assistance and Solar Savings Initiative

A partnership between IFF, South Bend’s Office of Sustainability, and CDFI Friendly South Bend is helping nonprofits refocus resources from energy costs back to their missions. With IFF’s support, the Energy Assistance and Solar Savings Initiative subsidizes energy assessments of nonprofits’ facilities and offers city grants for upgrades.

Photo: A rooftop solar installation at La Casa de Amistad (LCA) in South Bend. Photo courtesy of LCA.

Appleseed Childhood Education

Many rural communities face challenges sustaining or expanding resource- and labor-intensive services such as child and health care. Appleseed Childhood Education (ACE) is addressing that need in Rensselaer, a town of about 5,700. With the help of a $350,000 IFF loan and real estate support, ACE renovated a 7,500 sq. ft. facility into an ECE center on the Franciscan Health hospital campus. The center will provide 75 infants and toddlers with quality care and education and will be the first licensed ECE option in the community since 2018. The center will also strengthen Franciscan Health’s ability to recruit and keep highly qualified medical professionals.

Photo: The toddler room at Appletree Rensselaer. Photo courtesy of Tonn and Blank Construction.

Lending

- 72 child care slots

- 300 school seats

- 128 housing units

- 199,862 square feet of real estate developed

Illinois

IFF is headquartered in Chicago with 95 staff offering our full suite of services.

Lending

43 loans totaling $59.8 million

DetailsConsulting

36 real estate projects executed

Development

1 project completed

12 projects underway

Special Programs

Arts & Culture Loan Fund

Chicago’s Cultural Treasures

Quality Facilities for All

Stronger Nonprofits Initiative

Client Spotlights

Chicago Mahogany Foundation

With the help of a $317,063 IFF loan, Chicago Mahogany Foundation purchased a tour bus that will enable founder Shermann “Dilla” Thomas to highlight Chicago’s people, architecture, history, and world impact. Dilla’s work has been highlighted extensively by Chicago media and in national media, such as The Today Show.

Photo: Chicago Mahogany Foundation’s tour bus. Photo courtesy of Chicago Mahogany Foundation.

Poder

PODER secured a $3.3 million bridge loan from IFF to help consolidate three leased locations into one 7,000 sq. ft. facility it owns. The facility will enable PODER to help almost 2,500 Spanish-speaking immigrants annually find jobs and integrate into their new communities through ESL and workforce development training – nearly double its previous total.

Photo: PODER’s new headquarters facility. Photo by Zuno Photographic.

Academy for Global Citizenship

A new dynamic example of the role of schools in economic and community development is taking shape in Southwest Chicago. Construction is underway on the Academy for Global Citizenship’s (AGC) $53 million, six-acre campus, which will include an early childhood education center, Federally Qualified Health Center, production greenhouse, educational wetlands, orchards, and urban farm, which will provide 70% of the food for AGC students’ meals. A $9 million New Markets Tax Credit allocation from IFF provided critical capital for the project, which will create green construction jobs and provide workforce training in sustainable technologies.

Photo: An architect’s rendering of the AGC campus. Rendering courtesy of the Academy for Global Citizenship.

Lending

- 120 child care slots

- 62 school seats

- 21,960 health care visits

- 810 housing units

- 898,376 square feet of real estate developed

Development

- Over 330,712 square feet

- Over $213 million in project value

- 333 housing units

Michigan

In 2022, we opened our West Michigan office in Grand Rapids. More than 20 staff in both our offices offer our full suite of services throughout the state.

Lending

11 loans totaling $20.8 million

DetailsConsulting

12 real estate projects executed

Development

8 projects underway

DetailsSpecial Programs

Caring for MI Future: Facilities Improvement Fund

Hope Starts Here

Learning Spaces

Client Spotlights

Detroit Public Theatre

The Detroit Public Theatre was founded in 2015 to provide world-class professional theater to diverse audiences. A $1 million loan from IFF for renovations to their facility has enabled the organization to increase audience sizes, launch a residency program, tap into new revenue streams, and nearly double its staff.

Photo: Detroit Public Theatre’s performance space. Photo by Jessica Hatter.

Corktown Health

With the help of a financial feasibility study in 2022, Corktown Health is building on a proven model for providing high-quality, affirming health care to the LGBTQ+ community by expanding to a second location set to open in 2024. The project continued a long-term relationship between IFF and Corktown Health that has also included a loan.

Photo: An architect’s endering of Corktown Health’s new facility. Rendering courtesy of Corktown Health.

INDUSTRY Detroit

INDUSTRY Detroit is bringing together innovation, collaboration, and creative use projects and businesses. With the help of a $5 million IFF loan, INDUSTRY is rehabilitating and expanding a former school building into a 116,000 sq. ft. commercial hub for mission-driven and for-profit organizations alike, with 20,000 sq. ft. primarily intended for organizations owned or led by people of color and women. The $36.5 million project will feature easily reconfigurable workspaces to accommodate a wide range of business needs. An adjacent side street will become a plaza where food trucks can operate and the community can gather.

Photo: An architect’s rendering of the INDUSTRY Detroit facility. Rendering courtesy of INDUSTRY Detroit.

Lending

- 10,000 health care visits

- 257 housing units

- 573,755 square feet of real estate developed

Development

- Over 217,396 square feet

- Over $57 million in project value

- 704 child care slots

Missouri & Kansas

With staff based in both St. Louis and Kansas City, IFF offers our full suite of services — lending, development, real estate consulting, and research and evaluation — across the state of Missouri and in the Kansas City metro area.

Lending

10 loans totaling $7.5 million

DetailsConsulting

15 real estate projects executed

Development

1 project underway

DetailsSpecial Programs

Stronger Nonprofits Initiative – St. Louis

Stronger Nonprofits Initiative – Kansas City

Client Spotlights

Unleashing Potential (UP)

For more than 100 years, Unleashing Potential (UP) has provided empowering experiences to children in St. Louis. In 2022, participation in SNI and an IFF-led visioning workshop enabled UP to develop a strategic plan incorporating programming, learning opportunities, and facility development, supporting a path toward another century helping children and families.

Photo: Unleashing Potential event participants. Photo courtesy of Unleashing Potential.

Swope Health

With IFF serving as its owner’s representative, Swope Health began construction of a 32,000 sq. ft. facility in Kansas City, MO, that will open in 2023 as the PACE KC Adult Wellness Center. Designed to provide comprehensive, coordinated, and preventative care to patients aged 55+, the center will enable Kansas Citians to age gracefully in their community.

Photo: An architect’s rendering of the PACE KC Adult Wellness Center. Rendering courtesy of Swope Health.

LaunchCode

Since 2013, LaunchCode has helped more than 2,500 people with little to no experience begin computer science careers with companies such as Microsoft, Boeing, and Accenture. Following the 2022 completion of a $4 million renovation of its headquarters, LaunchCode’s annual program capacity increased from 600 to 800. The project started in 2019 with a $579,500 IFF loan that enabled the nonprofit to acquire the facility. LaunchCode participants, on average, double their annual earnings after completing the organization’s intensive training program.

Photo: The lobby in LaunchCode’s facility. Photo by PeaksViewPhoto.com.

Lending

- 125 school seats

- 1,750 health care visits

- 41 housing units

- 162,226 square feet of real estate developed

Development

- 15,000 square feet

- $10 million in project value

Ohio

Working out of our Columbus office, staff continue to deepen IFF’s presence in Ohio through lending, real estate consulting, and partnerships with organizations like the Cincinnati Development Fund.

Client Spotlights

Ronald McDonald House Charities of Central Ohio (RMHC)

Driven by consistently high demand for its services as partner hospitals in Columbus have expanded their pediatric capacity, Ronald McDonald House Charities of Central Ohio (RMHC) embarked on an expansion of its facility to nearly double its size to 230,000 sq. ft. – creating the world’s largest Ronald McDonald House. Doing so will enable the nonprofit to provide home-like accommodations and supportive services to 6,500 families annually whose children are hospitalized nearby. IFF provided a $7 million federal New Markets Tax Credit (NMTC) allocation and a $1 million Ohio NMTC allocation for the $28 million project, which is expected to be completed in early 2024.

Photo: RMHC expanded facility under construction. Photo courtesy of RMHC.

Rosemary’s Babies

Founded by Rosemary Oglesby-Henry to provide wraparound services to teen parents, Rosemary’s Babies used a $900,000 capital campaign bridge loan from IFF to acquire and begin renovating a 6,400 sq. ft. facility in Cincinnati’s Avondale neighborhood that will be known as Holloway House. Upon completion, Holloway House will include six temporary living spaces for moms and their babies, dining and activity areas, office space, and more – creating a safe haven for teen parents designed to support the development of life skills, help overcome barriers to finishing school and gaining employment, and facilitate positive peer support.

Photo: An architect’s rendering of Holloway House. Rendering courtesy of Rosemary’s Babies.

Lending

- 76,000 health care visits

- 133 housing units

- 138,134 square feet of real estate developed

Wisconsin

IFF’s Milwaukee office provides loans throughout the state, and staff from Chicago also provide real estate consulting in the Milwaukee metro area.

Client Spotlights

Movin’ Out and Red Caboose Childcare

Quality affordable housing and early childhood education (ECE) are crucial to growing and maintaining vibrant communities. That’s why Movin’ Out and Red Caboose Childcare chose to partner and work together under one roof to address both needs in Madison. IFF loans totaling $7.76 million will help the pair develop a 70,000 sq. ft. facility with 38 apartments – 32 for families earning 30-60 percent of the area median income and nine for people with disabilities – an ECE center with two community rooms, a kitchen, and six classrooms.

Photo: An architect’s rendering of Movin’ Out and Red Caboose Childcare’s shared facility. Rendering courtesy of Movin’ Out and Red Caboose Childcare.

Cinnaire Solutions

With a $5.5 million loan from IFF, Cinnaire Solutions and the 30th Street Industrial Corridor Corp are redeveloping 18 vacant single-family homes and duplex buildings in Milwaukee’s Garden Homes Historic District to create 24 units of rental housing affordable to families earning between 30-60% of the Area Median Income. The historic district dates back to the early 1920s, when the Garden Homes were developed as the first municipally sponsored housing project in the country, and the current rehabilitation project is a significant milestone in a community-led plan to more broadly revitalize the neighborhood.

Photo: Welcome sign in the Garden Homes neighborhood. Photo by Pam Ritger of City of Milwaukee ECO Office.

Lending

- 44 child care slots

- 854 school seats

- 133 housing units

- 481,381 square feet of real estate developed

Partners

“It’s impossible not to look back at this project and see that the door doesn’t open for any of it if we couldn’t purchase the building. At the time, it felt like a very imposing challenge. After being introduced to IFF, it became clear from the very first conversation that what we were facing wasn’t an unusual challenge and that IFF was there to help.”

Funders & Investors

INVESTOR CONSORTIUM MEMBERS

- Associated Community Development Bank

- Barrington Bank & Trust Company

- BMO Harris Bank

- Byline Bank

- Carrollton Bank

- CIBC Bank N.A.

- Citizens Bank

- Commerce Bank

- Crystal Lake Bank and Trust Company

- Evergreen Bank Group

- Fifth Third Bank CDC

- First Bank Chicago

- First Eagle Bank

- First Merchants Bank

- First National Nebraska CDC

- First Savings Bank of Hegewisch

- Hinsdale Bank and Trust

- Huntington Community

Development Corporation - Lake Forest Bank and Trust

- Lakeside Bank

- Libertyville Bank and Trust

- Midland States Bank

- Midwest BankCentre

- Mission Investment Fund of the Evangelical Lutheran Church in America

- MUFG Union Bank N.A.

- Northbrook Bank and Trust

- Northern Trust

- North Shore Community Bank and Trust

- Old National Bank

- Old Plank Trail Community Bank and Trust

- PNC Bank

- Providence Bank & Trust

- Simmons Bank

- St. Charles Bank and Trust Company

- State Bank of the Lakes

- State Farm Mutual

- Stifel Bank & Trust

- TD Bank N.A.

- TIAA-CREF Trust Company, FSB

- Town Bank

- Twain XX LLC

- U.S. Bank

- Village Bank and Trust

- Wheaton Bank and Trust

- Wintrust Financial

NOTE PROGRAM INVESTORS

Faith-Based Institutions

- Adrian Dominican Sisters

- The Benedictine Sisters of Chicago

- Benedictine Sisters of the Sacred Heart

- Congregation of the Sisters of St. Joseph

- Institute of the Blessed Virgin Mary

- Mercy Investment Services

- Mount St. Scholastica

- Missionary Sisters of the Sacred Heart

- Religious Communities Impact Fund

- Seton Enablement Fund

- Sinsinawa Dominican Sisters

- Sisters of Charity of Leavenworth

- Sisters of Charity of Nazareth, KY

- Sisters of the Holy Name of Jesus and Mary U.S.-Ontario Province

- Sisters of the Most Precious Blood of O’Fallon, MO

- Sisters of St. Francis, Clinton, Iowa

- Sisters of St. Joseph of Carondelet, St. Louis Province

- Sisters, Servants of the Immaculate Heart of Mary

- St. Viator High School

Foundations, Corporations, Universities, and Individuals

- Arc Chicago (Benefit Chicago)

- Bank of America

- Blowitz-Ridgeway Foundation

- BMO Harris Bank

- Cathay Bank

- Chicago Community Foundation

- Citizens Bank N.A.

- Federal Home Loan Bank of Chicago

- First Savings Bank of Hegewisch

- Richard W. Goldman Family Foundation

- Goldman Sachs Social Impact Fund

- Greater Cincinnati Foundation

- JPMorgan Chase

- The Kresge Foundation

- Marquette Bank

- Timothy & Risa McMahon

- North Shore Bank

- Northern Trust

- Opportunity Finance Network

- Opus Foundation

- PNC

- Pritzker Family Foundation

- Rotary Charities of Traverse City

- Starbucks Corporation

- University of Chicago

- U.S. Bancorp Community Development Corp.

- U.S. Bank N.A.

- Village Bank and Trust

- W.K. Kellogg Foundation

- The Walton Family Foundation

- Wisconsin Preservation Fund

- Wells Fargo Bank

- Woodforest National Bank

- YouthBridge Community Foundation

Hospital Systems

- Advocate Aurora Health

- American Medical Association

- Ann & Robert H. Lurie Children’s Hospital of Chicago

- CommonSpirit Health

- Rush University Medical Center

- Trinity Health

MICHIGAN IMPACT CONNECTION

- Ann Arbor Area Community Foundation

- Max M. and Marjorie S. Fisher Foundation

- Grand Haven Area Community Foundation

- Grand Rapids Community Foundation

FUNDERS

Foundations, Corporations, and Individuals

- Breaking Ground

- The Builders Initiative

- Chicago Community Foundation

- The Chicago Community Trust

- CIBC

- Community Focus Fund

- Early Childhood Investment Corporation (ECIC)

- Everybody Ready

- Max M. and Marjorie S. Fisher Foundation

- Ford Foundation

- The Glick Fund

- Goldman Sachs Foundation

- Greater Milwaukee Foundation

- The Joyce Foundation

- JPMorgan Chase Foundation

- Kansas Health Foundation

- The Ewing Marion Kauffman Foundation

- The Kresge Foundation

- Local Initiative Support Corporation (LISC)

- John D. and Catherine T. MacArthur Foundation

- Robert R. McCormick Foundation

- National Urban League

- North Chicago Education Fund

- Northwest Housing Partnership

- Old National Bank

- Opportunity Finance Network

- Polk Bros. Foundation

- PNC Foundation

- Pritzker Children’s Initiative Foundation

- J.B. and M.K. Pritzker Family Foundation

- Providence Bank and Trust

- MacKenzie Scott

- SSM Health Care

- Stateline LLC

- Terra Foundation of American Arts

- U.S. Bank

- W.K. Kellogg Foundation

- Walder Foundation

- The Walton Family Foundation

- The Harry and Jeanette Weinberg Foundation

- Ralph C. Wilson, Jr. Foundation

Government

- Chicago Metropolitan Agency for Planning

- Chicago Public Schools

- City of Rockford

- City of South Bend

- Illinois Housing Development Authority

- Michigan Department of Education

- U.S. Department of Education

- U.S. Department of the Treasury

2022 Board Members

George Burciaga

CEO & Managing Partner, Elevate Cities

Chicago, IL

Hamilton Chang

Executive Editor & Board Member, Mandarin Leader Media & Magazine

Chicago, IL

EVELYN DIAZ

President, Heartland Alliance

Chicago, IL

Sidney Dillard

Partner, Head of Corporate Investment Banking Division, Loop Capital Markets

Chicago, IL

Jim Due

Senior Vice President, Head of Credit Risk & Policy,

Northern Trust

Chicago, IL

Tiffany Hamel-Johnson

President & CEO,

Chicago United

Chicago, IL

Monique B. jones

President & CEO,

Forefront

Chicago, IL

Rodney Jones-Tyson

Global Chief Human Resources Officer, Managing Director, Robert W. Baird & Co.

Chicago, IL

Emmet Pierson

President & CEO, Community Builders of Kansas City

Kansas City, MO

George Mui

Managing Partner, Global Consultants United

Chicago, IL

Angie Reyes

Executive Director & Founder, Detroit Hispanic Development Corp.

Detroit, MI

John Sassaris

Senior Vice President & Market Executive, Fifth Third Bank

Chicago, IL

Sakura Takano

Chief Executive Officer, Rotary Charities of Traverse City

Traverse City, MI

Robbyn Wahby

Executive Director, Missouri Charter Public School Commission

St. Louis, MO

Cheryl Wilson, Chair

Managing Director and Head of Community Development Lending, CIBC Bank USA

Chicago, IL

Loan Task Force

Bruce Bryant

Fifth Third Community Development Corp.

Dublin, OH

Joseph Dennison

RBS Citizens N.A.

Southfield, MI

Jim Due

Northern Trust

Chicago, IL

Guy Eisenhuth

Village Bank and Trust, a Wintrust Community Bank

Arlington Heights, IL

Rebecca McCloskey

First Midwest Bank

Arlington Heights, IL

Dave McClure

Youth Service Bureau of Illinois Valley

Ottawa, IL

Courtney Olson

First Bank of Highland Park

Highland Park, IL

Michael Rhodes

JPMorgan Chase

Chicago, IL

Katya Shirley

Bank of America

Chicago, IL

Advisory Councils

Community Advisory Council

terese caro

Legacy Redevelopment Corp.

Milwaukee, WI

Evelyn Diaz

Heartland Alliance

Chicago, IL

Renee Kent

Communities First

Flint, MI

Kathryn McHugh

BlueHub Capital

Roxbury, MA

Marion Moore

Allies for Community Business

Chicago, IL

DOUG RASMUSSEN

Steadfast City

St. Louis, MO

SARA VANSLAMBROOK

United Way of Central Indiana

Indianapolis, IN

Chicago Advisory Council

Karen Freeman-Wilson

Chicago Urban League

ayesha jaco

West Side United

monique B. jones

Forefront

bo kemp

Southland Development Authority

ryan priester

John D. and Catherine T. MacArthur Foundation

Claire Rice

Arts Alliance Illinois

nicole robinson

YWCA Metro Chicago

KIMBERLEY RUDD

Rudd Resources

Christine Sobek

Waubonsee Community College

Leticia Reyes-Nash

Health Management Associates

Detroit Advisory Council

Ryan Friedrichs

Related Co.

Lisa Johanon

Central Detroit Christian Community Development Corp.

Kirk Mayes

Forgotten Harvest

Angie Reyes

Detroit Hispanic Development Corp.

Kurt Strehlke

Bank of America

Kansas City Advisory Council

ruben alonso

AltCap

deidre anderson

EarlystART

mclain bryant macklin

Health Forward Foundation

scott hall

Kansas City Chamber of Commerce

steven lewis

Mid-America Regional Council

emmet pierson

Community Builders of Kansas City

St. Louis Advisory Council

Zachary Boyers

U.S. Bancorp Community Development Corp.

Maxine Clark

Clark-Fox Family Foundation

Matt Oldani

Deaconess Foundation

Jason Purnell

BJC HealthCare

Darlene Sowell

Unleashing Potential

Robbyn Wahby

Missouri Charter Public School Commission