By The Numbers

-

Lending Highlights

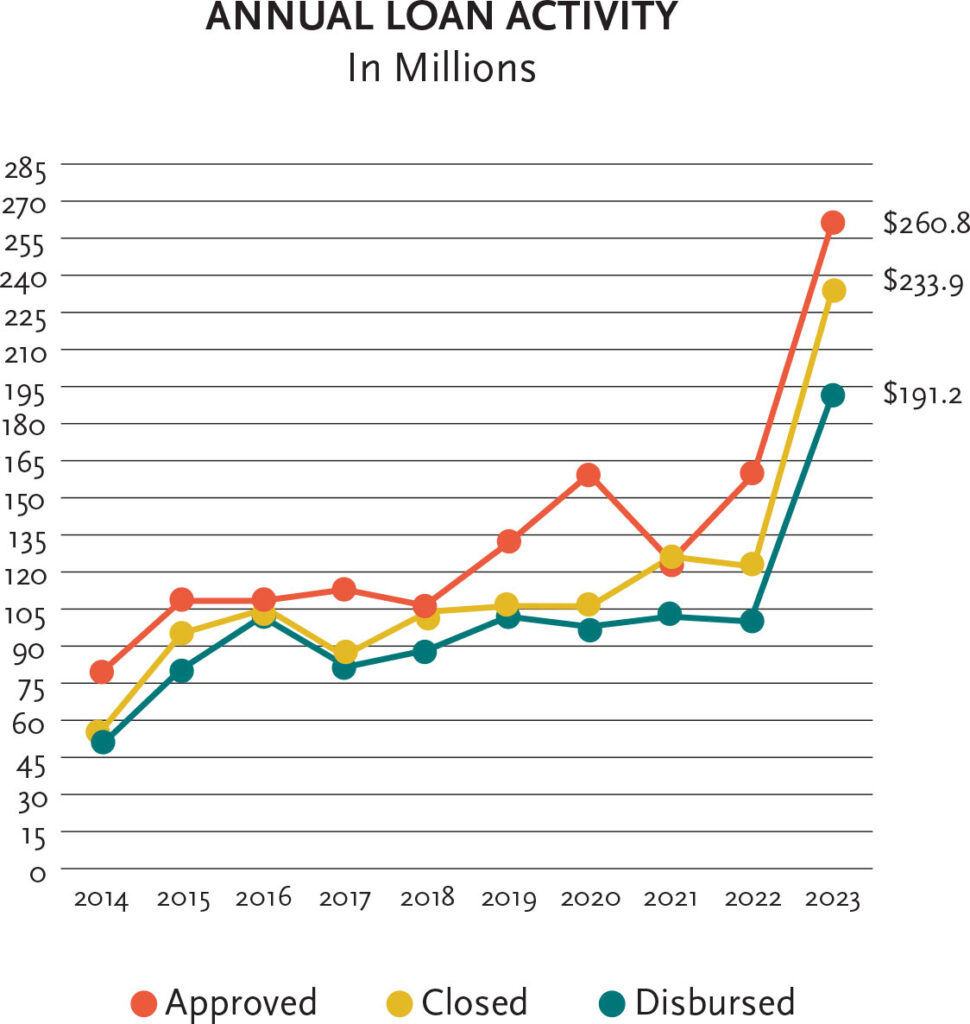

This year, IFF closed more loans to more nonprofits than ever before. These loans – big and small – empower nonprofits to do more for their communities and remain an indispensable component in our continuum for social impact.

The map below illustrates IFF’s impact over our 35 year history with loans and real estate projects happening across the Midwest.

20231988-2023# Loans Closed153# Loans Closed2,253# Loans Closed$ Loans Closed$233.9 M$ Loans Closed$1.6 B$ Loans ClosedCapital Leverage$1.35 BCapital Leverage$5.83 BCapital Leverage# Nonprofits Served132# Nonprofits Served1,207# Nonprofits ServedSF of Real Estate Developed4.97 MSF of Real Estate Developed42 MSF of Real Estate Developed -

Lending Impact Numbers

When nonprofits have access to flexible financing designed with their needs in mind, they can create safe, inspiring facilities to support their clients and strengthen their communities.

20231988-2023Student seats1,332Student seats160,956Student seatsChild care slots272Child care slots16,041Child care slotsHousing units created/preserved3,290Housing units created/preserved20,589Housing units created/preservedNew patient visits69,371New patient visits725,598New patient visits -

Loan Portfolio

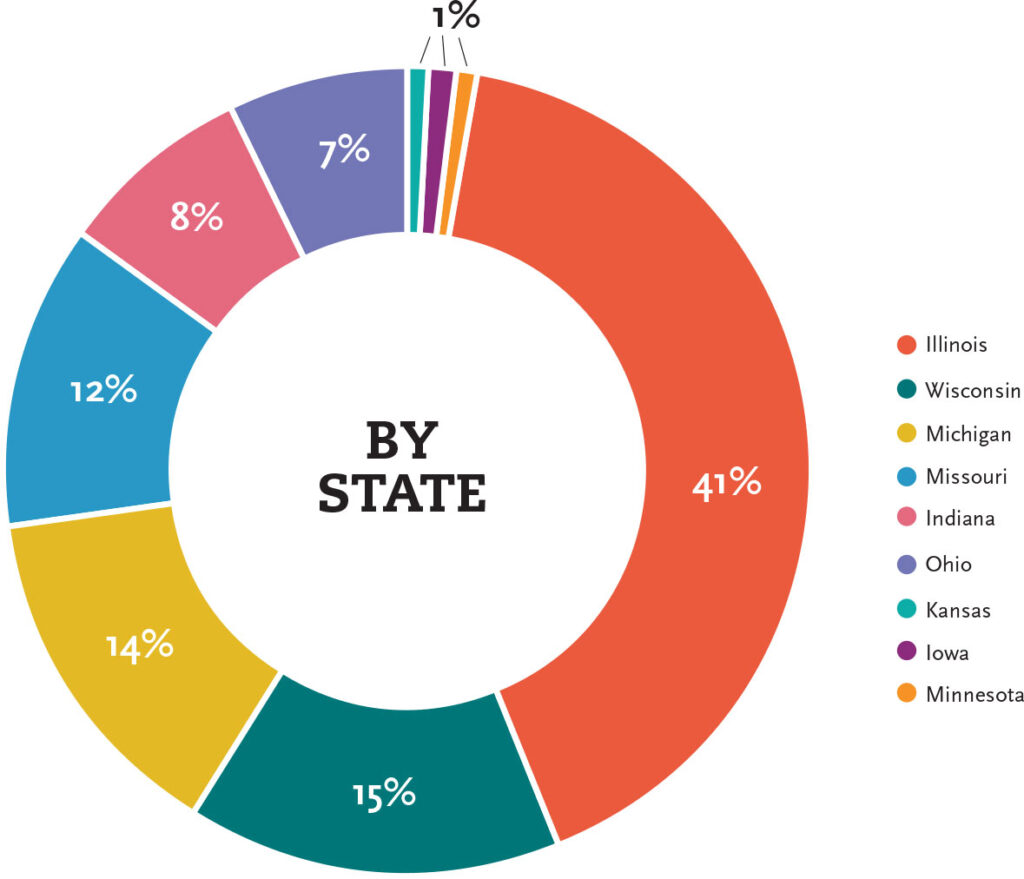

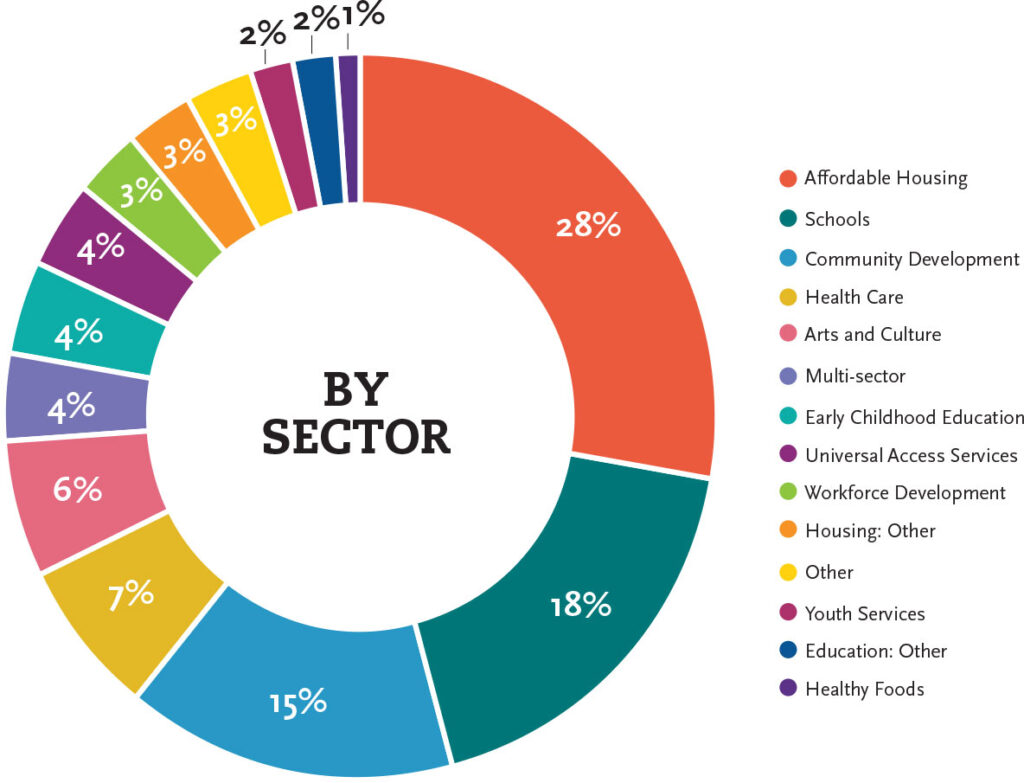

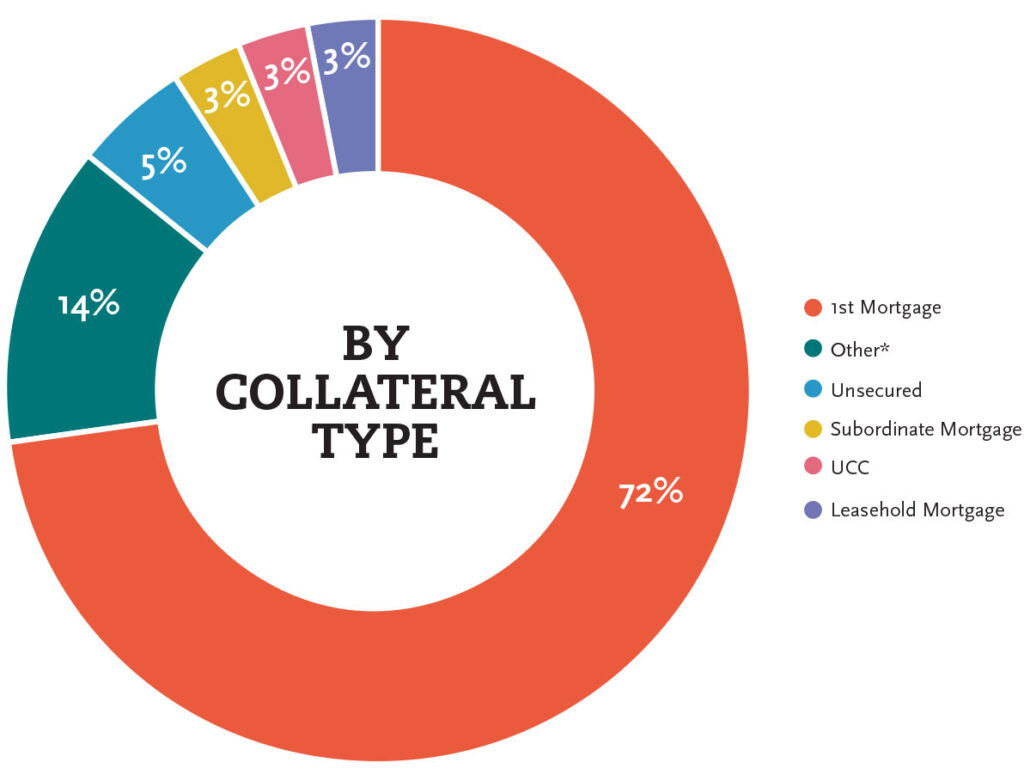

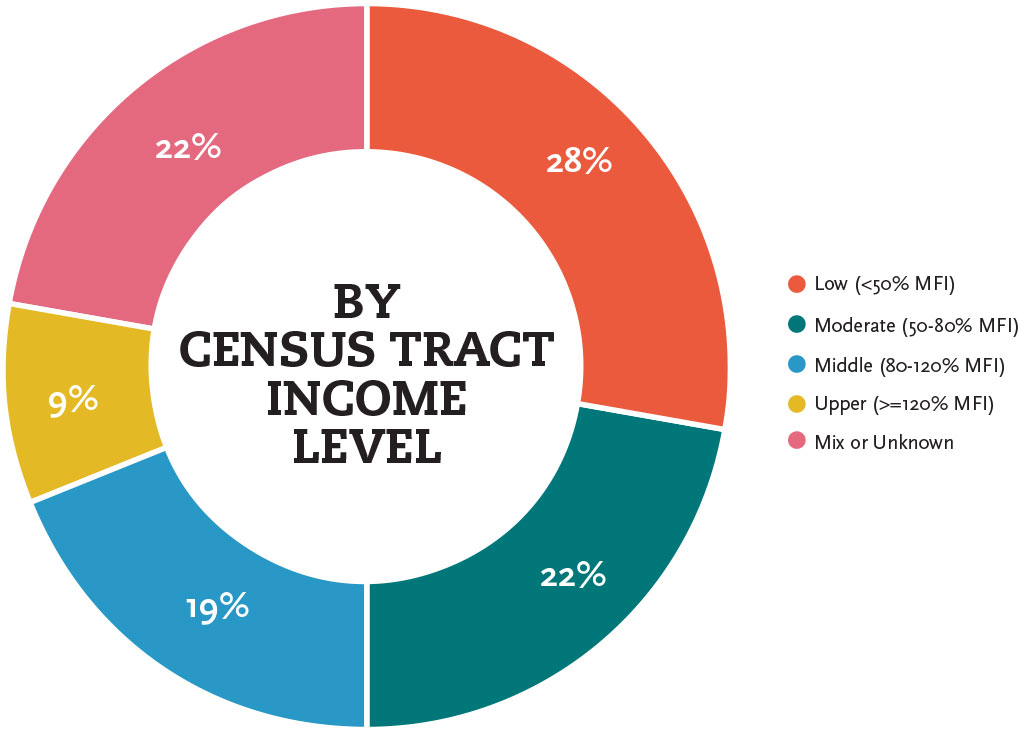

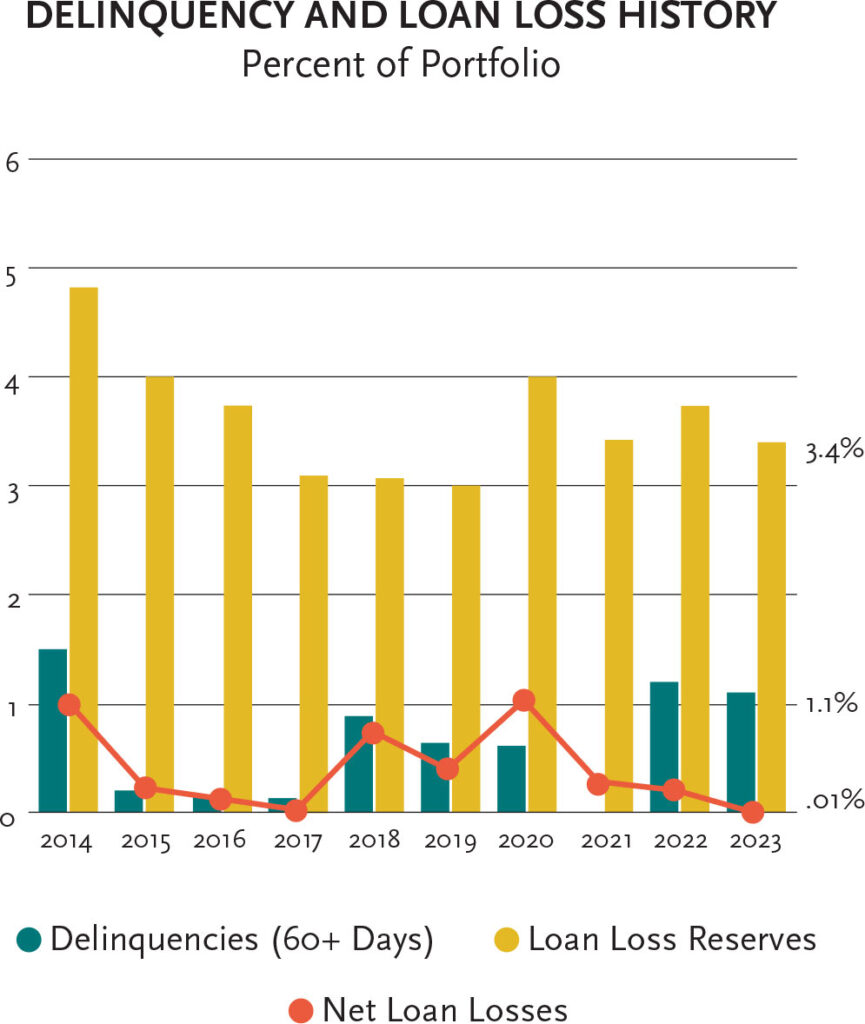

Our commitment to supporting the full range of nonprofits across the Midwest provides our investors with a well-secured and diversified loan portfolio. These graphs reflect the percentage of dollars in IFF’s portfolio of loans — which, as of Dec. 31, 2023, included 720 loans totaling $559.3 million.

Included in the figures below are loans made under our innovative New Markets Tax Credit (NMTC) Small Project Loan Pool, which brings the benefits of NMTC financing — low rates and seven-year, interest-only payments — to smaller nonprofit projects throughout the Midwest.

-

*The vast majority of “other” represents NMTC transactions where IFF generally has an indirect interested in the collateral due to the program’s structuring requirements.

Data gathered by the U.S. Census and other federal agencies/programs — notably the Community Reinvestment Act, Housing and Urban Development, and Home Mortgage Disclosure Act — have transitioned to these new labels from income level. While the labels have changed, the percentages based on Median Family Income (MFI) have remained the same; what were “very low” and “low” are now “low” and “moderate."

-

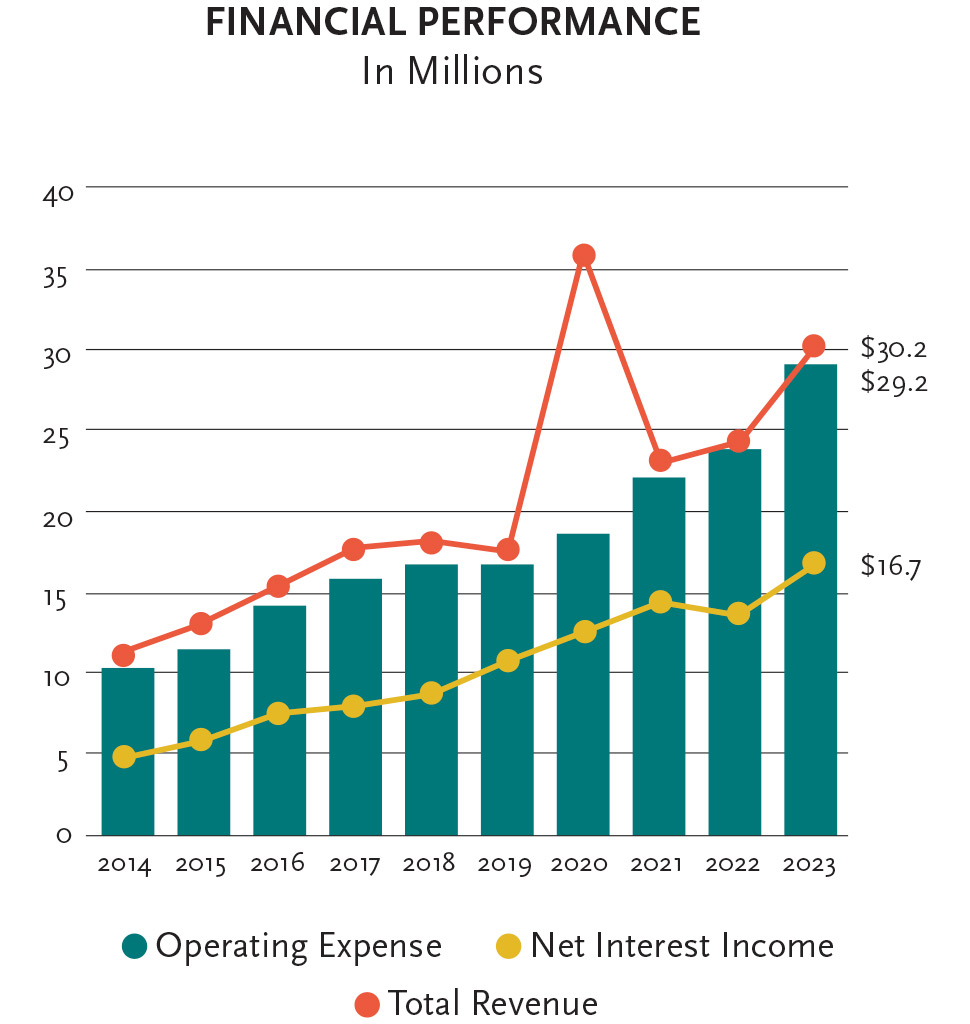

Financial Performance

Ensuring a financially strong IFF is key to maximizing our ability to best deliver on our mission. In 2023, IFF continued to maintain a strong track record of performance. Rated four-star, AAA+ from AERIS, positioning IFF as one of the handful of CDFIs in the country to merit this top rating for both impact and financial condition.

The noticeable spike in our revenues in 2020 was due to a one-time major gift of $15 million from philanthropist MacKenzie Scott.

-

-

Managed Assets Data

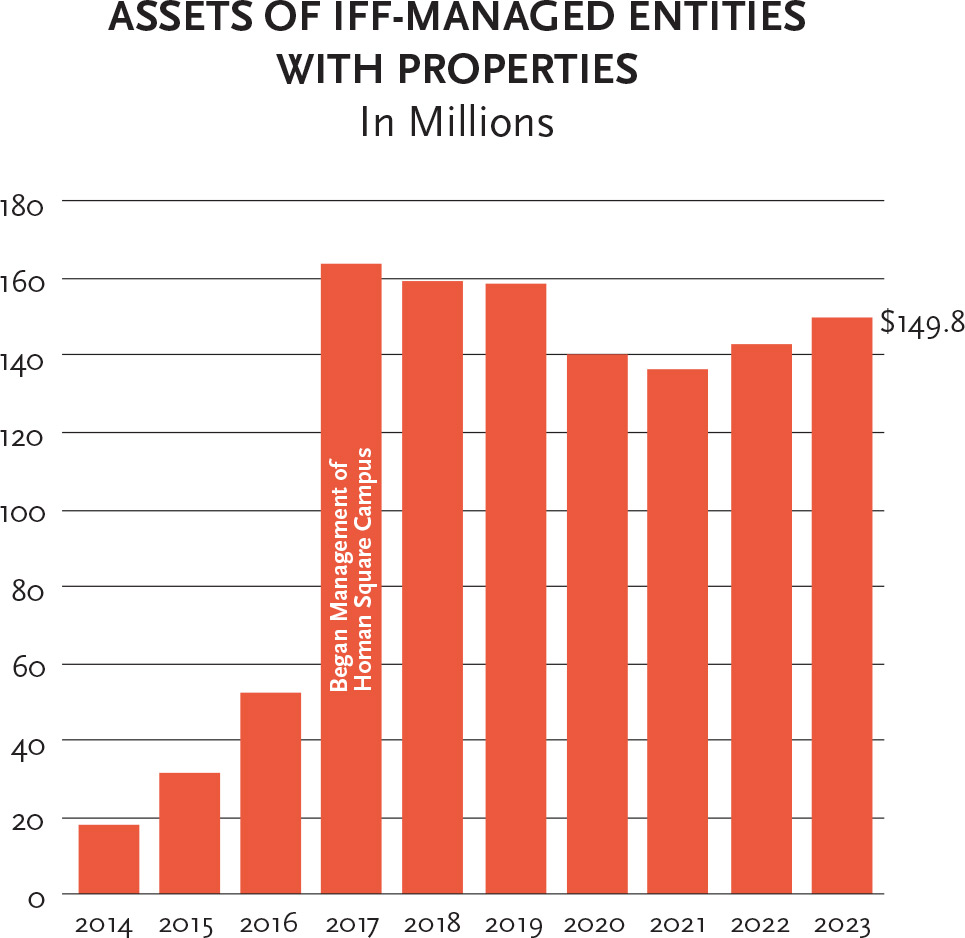

Strong nonprofits are essential to strong communities, and the ability of nonprofits to own their facilities is a key part of that equation. Most of the time, that’s where we start — our lending and consulting tools are designed to support nonprofits ready to own facilities.

Sometimes, IFF will temporarily own facilities during a predevelopment or construction phase as permanent financing is acquired — or, a bit longer as operations stabilize — before transferring them back to local hands. Other times, and always at the direction of the community, IFF acts as a permanent, long-term owner where no other potential owner is present or ready, but the community demand for the facility is strong.

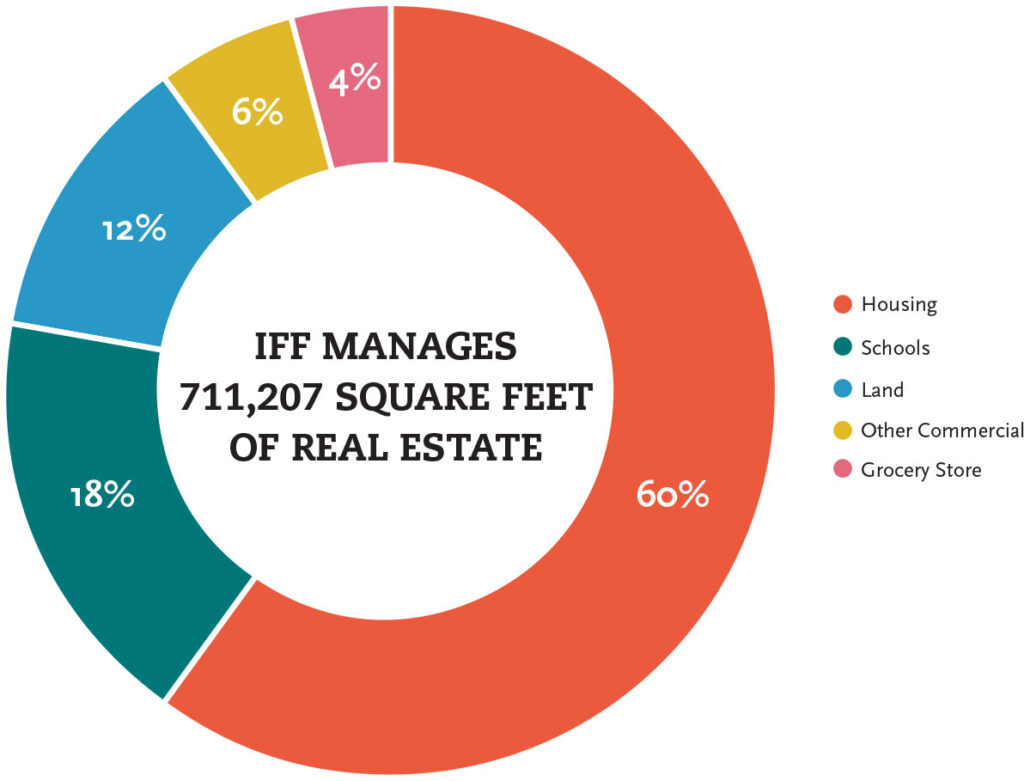

IFF now owns and/or manages nearly three-quarters of a million square feet of real estate across our footprint.

-

Development Data – Community Development Solutions & Home First

IFF serves as a real estate developer to launch community-driven projects. We work closely with community development partners to identify gaps where impactful projects would not happen through traditional development avenues. In 2023, driven by our equitable community development principles, IFF completed two project milestones and had seven projects under development, representing a total of over 155,020 square feet and more than $92.11 million in value.

Completed in 2023Under Development# Projects2# Projects7# ProjectsTotal Value of Projects$9.81 MTotal Value of Projects$82.3 MTotal Value of ProjectsTotal Sq. Feet of Projects22,020Total Sq. Feet of Projects133,000Total Sq. Feet of Projects# Housing Units (not inc. sq. ft. total)120# Housing Units (not inc. sq. ft. total)145# Housing Units (not inc. sq. ft. total)