A blog by IFF CEO Joe Neri

Effective CDFIs spend enormous amounts of time doing two things: (1) assembling capital – both scarce debt dollars and even scarcer equity dollars; and (2) deploying those dollars in communities we care about.

But as challenging and time-consuming as raising and deploying capital can be … it’s not enough. Our goal is not only to raise and deploy capital – most banks do that. Our goal is to align capital with justice.

That means deploying the capital we raise in ways that mitigate and eventually solve our communities’ economic, health, education, environmental and social problems – that’s what successful community development projects look like. To do that, CDFIs must engage across a continuum of activities – beyond raising capital and deploying loans – that build the pipeline of community-driven “investable projects” in all of our communities.

The Continuum

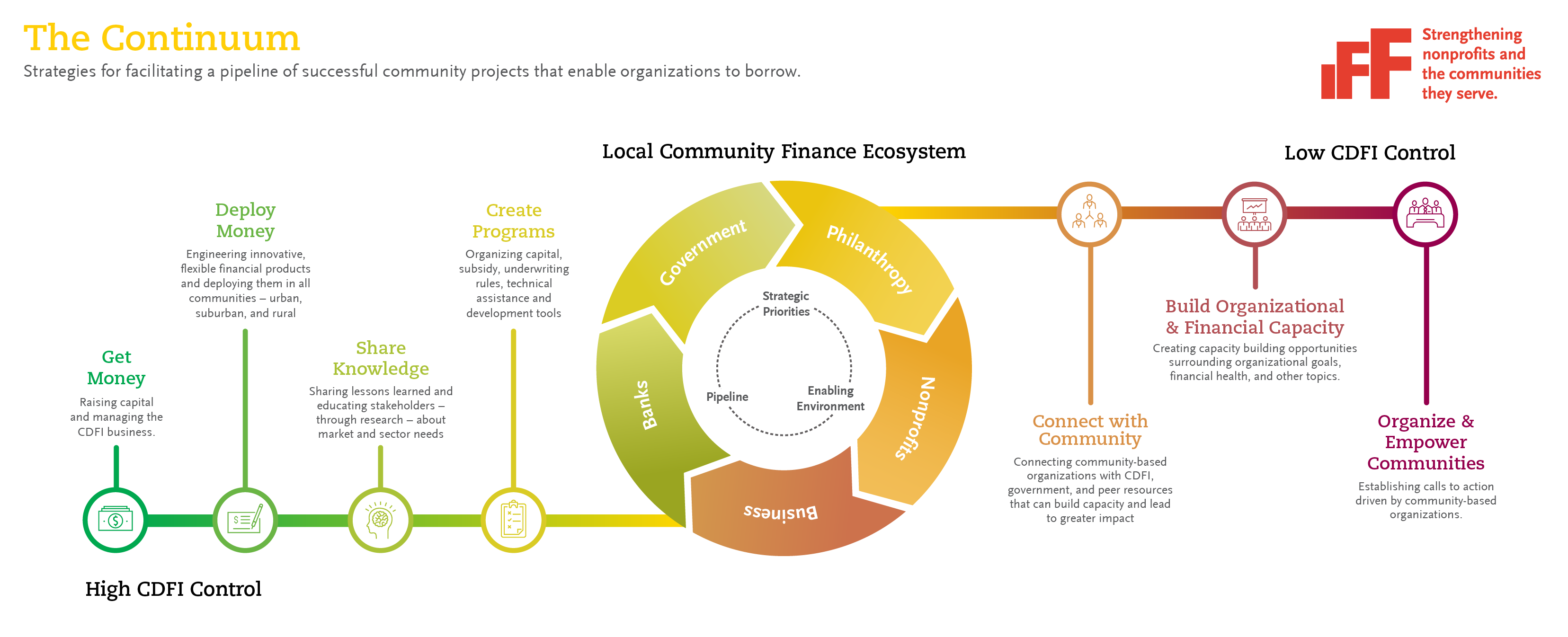

CDFI capacity is a vital part of a mature community finance ecosystem that also requires cooperative and collaborative infrastructure from government, philanthropy, business, nonprofits, and the civic community. Within that ecosystem, CDFIs can facilitate successful community projects in multiple ways – this is the basic premise of the continuum. Put another way: While many stakeholders are responsible for the success of the entire ecosystem, CDFIs can and must lead the way.

Assembling capital for communities – which CDFIs typically focus on – is only one element along the continuum that will lead to successful projects. In fact, since every bank assembles capital to lend, I would argue that the other components of the continuum are much more important to the CDFI industry’s focus on aligning capital with justice.

Figure 1 delineates the basic continuum that I want to explore in this blog (click to expand):

From left to right, the continuum progresses from the strategies that CDFIs most control to the strategies that CDFIs control the least. In the middle are strategies that require strong partnerships to implement. So, for example, assembling capital is all the way on the left (lots of CDFI control), providing capacity-building training to our borrowers is in the middle (shared CDFI control), and community organizing is all the way on the right (very little CDFI control).

So, isn’t this just “capacity building”?

Yes and no.

Yes, we need to keep doing – and significantly raising the profile of – our capacity-building work, which is at the heart of the CDFI Fund’s requirement for CDFIs to provide “development services” that mitigate the challenges to accessing capital in our communities. The most common “development services” strategy that CDFIs offer is training that helps our borrowers better understand what lenders are looking for, so that they can prepare better applications and better qualify for capital.

No, it’s not “just” capacity-building – we also need to engage in other activities across the continuum to be successful, and CDFIs must serve as leaders and conveners of the many diverse stakeholders that it takes to nurture a healthy ecosystem. Government programs like the CDFI Fund support our most basic capacity-building efforts. Philanthropy supports additional, targeted programs with subsidies, PRIs, and other innovative models. Nonprofits must be willing and able to leverage those programs so they remain financially strong in order to continue providing critical services to communities. CDFIs provide the connective tissue between these players, ensuring that our programs are informed by all constituents and therefore more effective.

While I’ll explore each of these topics in more detail in future posts, here are some initial thoughts on how CDFIs can intervene across the continuum:

- Raising & Deploying Debt – Left Side of Continuum: In addition to raising and deploying debt, every CDFI knows that how we engineer our financial products greatly increases or reduces eligibility for our capital. Of course price matters, but terms and covenants matter more to the communities we are trying to reach. This is an area where CDFIs truly excel. But we can do more by asking ourselves tough questions, such as: How would we design/change our terms/conditions if we applied a racial equity lens to our lending programs? Would those changes help us better reach communities of color? If your community facility loans were based on actual project costs instead of appraised value, how many more “investable” projects would get done or get done faster? IFF has been lending this way for 30 years. I can’t imagine how many fewer projects we would have financed if we required appraisals to define the “value” of invaluable projects like early learning centers and health clinics.

- Community Organizing – Right Side of Continuum: On the other side of the continuum is the fundamental capacity of community-based organizations to organize their resources and collectively call for specific changes in their communities. But as we all know, systemic injustice has deprived many communities of the resources they need to develop this capacity. More recently, this problem has extended to suburban communities, which we tend to think of as resource-rich, but which have been caught off-guard by significant demographic changes – the suburbanization of poverty. In any community that lacks this organizing capacity and infrastructure, it is one of the greatest barriers to aligning capital with justice, and it creates a frustrating “chicken and egg” cycle for lenders who aren’t willing to engage across the continuum. CDFI leaders can work to help develop capacity by serving on local boards and governmental task forces and provide valuable data. Government and philanthropy must also step up to help develop this infrastructure.

- Strengthening the Ecosystem – Center of Continuum: As we build capacity at both ends of the continuum, we will increase the number and diversity of “investable community projects,” but we will also strengthen the community finance ecosystem – which, in turn, helps us better serve our communities. That ecosystem and its functions are best articulated in The Capital Absorption of Places and Community Investment: Focusing on the System. Robin Hacke, David Wood, Katie Grace, and Marian Urquilla did a great service to our industry by articulating a framework for a functioning ecosystem that promotes capital absorption. That framework includes: setting strategic priorities, generating pipeline, and building an enabling environment that better ensures we are aligning our capital with justice. One example of CDFIs and funders embracing this framework is JPMorgan Chase’s Pro Neighborhood Program, which encourages CDFI collaborations – leading, in part, to co-lending arrangements that support deals that might not otherwise get financed.

By better delineating the continuum, CDFIs can better articulate how they can lean in at each stage of the continuum to create more “investable projects” – and, ultimately, to better align capital with justice.

Good news – we’re already doing this (but could do better)

Building the ecosystem means being responsible for making sure that we have “investable” projects that restore and promote justice wherever there is injustice. There are many great examples of CDFIs working along the continuum to do just that. I plan to partner with other CDFI leaders to detail some of them in future posts but, for now, here are just a few quick examples:

- Reinvestment Fund’s research and analysis on food systems created a whole new avenue for CDFIs to better engage in food access. That research lowered the “underwriting knowledge” bar for the entire industry, which in turn increased our collective capacity to better lend to grocery stores operating in food deserts – and, in turn, to better align our capital with food access justice.

- Capital Impact Partners (CIP) recently launched a program in Detroit to lend to local developers of color in order to bolster inclusivity within Detroit’s booming real estate market. To do that, they had to partner with National Development Council and other local CDFIs to create a technical assistance program to support budding minority developers by providing them with mentorship, management training, project budgeting, project and contractor management, legal services and community engagement that would make them better and more secure borrowers. Yes, CIP had to assemble patient capital from JP Morgan Chase; but this program recognizes that just assembling the special capital is not enough to be successful. If future borrowers are not better prepared to take on the capital, it will not flow or it will not flow for long.

- IFF’s Stronger Nonprofits Initiative brings together nonprofits serving communities of color in Chicago for an intensive cohort program that provides both some of the more ‘traditional’ capacity-building trainings – in our case, related to financial management and real estate planning – but also fosters a strong community of learning and practice among the participants. A combination of workshops, one-on-one coaching, and peer-learning over several months helps prepare these mostly-smaller nonprofits to make decisions about taking on debt and tackling real estate challenges.

Call to action

We should be very proud of the growth and maturity of our work and, yes, that our balance sheets are much bigger – scale matters, and it is essential to making meaningful change. But it is also clear that not all of our community development pond is healthy. My evidence? Every time I hear someone say: “Well I would invest there, but I didn’t receive any applications from the area.”

Where are the applications?? You tell me. As CDFIs, part of our job is to make sure there are investable deals everywhere. We can do that by participating in the entire ecosystem and by owning our role as a leader and convener of all the stakeholders that together lead to more and stronger investment opportunities. We must go beyond raising and deploying capital to aligning activities that span the continuum.

I don’t mean to suggest that this continuum is complete. In fact, I’m hoping that through this blog we can edit and refine it – together. As we explore these topics in more depth in future posts, I hope readers will help populate models and examples of programs across the continuum. My not so secret plan is to replicate and riff off of the good ideas to better serve our Midwest communities, especially in the rural and suburban areas that historically get less attention from CDFIs. Do you have examples of programs, initiatives, efforts, and collaborations to share? Please do.