Because of how the NMTC program is structured, smaller projects don’t generate enough return for investors to justify the use of NMTCs. Any project with a budget less than $7 million isn’t likely to secure NMTCs as a result.

Resources nonprofit leaders can use

Since 1988, IFF has closed $1.4 billion in loans for more than 1,100 nonprofits, putting flexible capital in the hands of changemakers to help bring their visions for stronger communities to life. We’re sharing some of what we’ve learned over the past 36 years to help nonprofit leaders better understand how to leverage financing to amplify impact, how to evaluate and manage facilities projects, and more.

The federal government’s New Markets Tax Credits (NMTC) program was created in 2000 to incentivize community development and economic growth in under-resourced neighborhoods, offering nonprofits a powerful new financing tool designed to amplify the impact of mission-driven work. Put simply, the primary benefit of leveraging NMTCs to complete a large-scale nonprofit facility project is that it provides the organization with an equity investment or financing that won’t have to be repaid if all of the conditions associated with the tax credits are met.

Given the relative infrequency of such projects, however, NMTCs generally aren’t well understood in the nonprofit sector. The complexity of NMTCs further contributes to confusion about what they are and how they work, illustrated by the fact that very few of these projects are completed without the support of a dedicated NMTC expert or consultant. And while good consultants are indispensable, there’s also value for nonprofit leaders in understanding the fundamentals of the NMTC program before engaging a consultant.

Toward that end, we’ve compiled a primer on NMTCs designed to:

- Help nonprofit leaders evaluate whether their organization’s facility project is a good fit for an NMTC allocation based on project type, location, anticipated impact, timing, and more;

- Explain how the tax credits work with a step-by-step walkthrough of an example transaction;

- Define key terms, and;

- Provide real-world examples of how nonprofits have used NMTCs to their benefit by highlighting a handful of IFF’s NMTC projects.

What types of projects are most likely to receive New Markets Tax Credits?

To apply for NMTCs, nonprofits must complete an application from a “Community Development Entity” (CDE) that has been allocated NMTCs by the U.S. Department of the Treasury’s CDFI Fund. Within the general framework for the NMTC program established by the CDFI Fund, each CDE has unique criteria for how it determines which organizations that apply for NMTCs will receive them. Because of that, it’s important to find a CDE whose unique criteria align with the organization’s project goals to maximize the chances of receiving an NMTC allocation.

As a baseline, nonprofit leaders should consider the following when evaluating whether NMTCs are worth pursuing for their organizations’ projects:

The types of projects by nonprofit sponsors that most frequently secure NMTCs are health care centers, community centers, child care facilities, charter schools, food banks, grocery stores, vocational training facilities or other spaces that support workforce development, emergency and rehabilitation shelters, community hubs, and arts and culture facilities.

Nonprofits must demonstrate that alternative sources of funding or financing cannot be secured to bridge the funding gap for which NMTCs are sought.

Projects must be located in a geographic area with documented need and should directly address a gap or inequity in the area. In many cases, CDEs provide NMTCs only in communities classified as “severely distressed” because that is viewed more favorably by the CDFI Fund.

Whether building a new facility or renovating and expanding an existing one, the project must generate new, positive, and direct impacts for under-resourced communities (e.g., creating a large number of local jobs, providing needed goods or services, fostering BIPOC business ownership, and/or creating environmentally sustainable outcomes) that can be quantified and tracked. Because securing NMTCs is a competitive process, the bigger the positive impact of the project, the more likely it is that an organization will be able to access them. Impact as it relates to NMTCs is defined in large part by what the community needs.

In an under-resourced neighborhood defined by the U.S. Department of Agriculture as a “food desert,” for example, a new grocery store is likely to have a significant impact – both by creating jobs in the community and ensuring that residents don’t have to travel elsewhere to access fresh, affordable foods that support their health and wellness. The same project would have much less of an impact and be less likely to be awarded NMTCs in a community that already has a full-service grocery store.

Demonstrating that community members and stakeholders support the project is essential. This means that the nonprofit will need to spend time engaging these individuals and organizations before submitting an application to ensure that it can demonstrate this support.

CDEs typically want the project to be ready to begin shortly after the NMTC transaction closes. This is because the CDE will be judged on how quickly it deployed its NMTC allocation when applying to the CDFI Fund for future allocations. If a project isn’t likely to begin until months after NMTC funding is disbursed, the organization applying for an allocation should consider waiting until the CDE’s next application cycle to ensure that construction can begin quickly.

If all of the criteria above are met, the organization might benefit from engaging an NMTC consultant to help navigate the application process and, if successful, the NMTC transaction itself. An experienced consultant can play a critical role in managing the complexity of the transaction, thus reducing the operational burden on the organization. The organization should still be prepared to handle a large volume of legal documents and be equipped to adhere to strict programmatic compliance requirements after the transaction closes. One of the best ways to find a consultant is to talk to other nonprofits that have engaged one for a project.

How do New Markets Tax Credit transactions work?

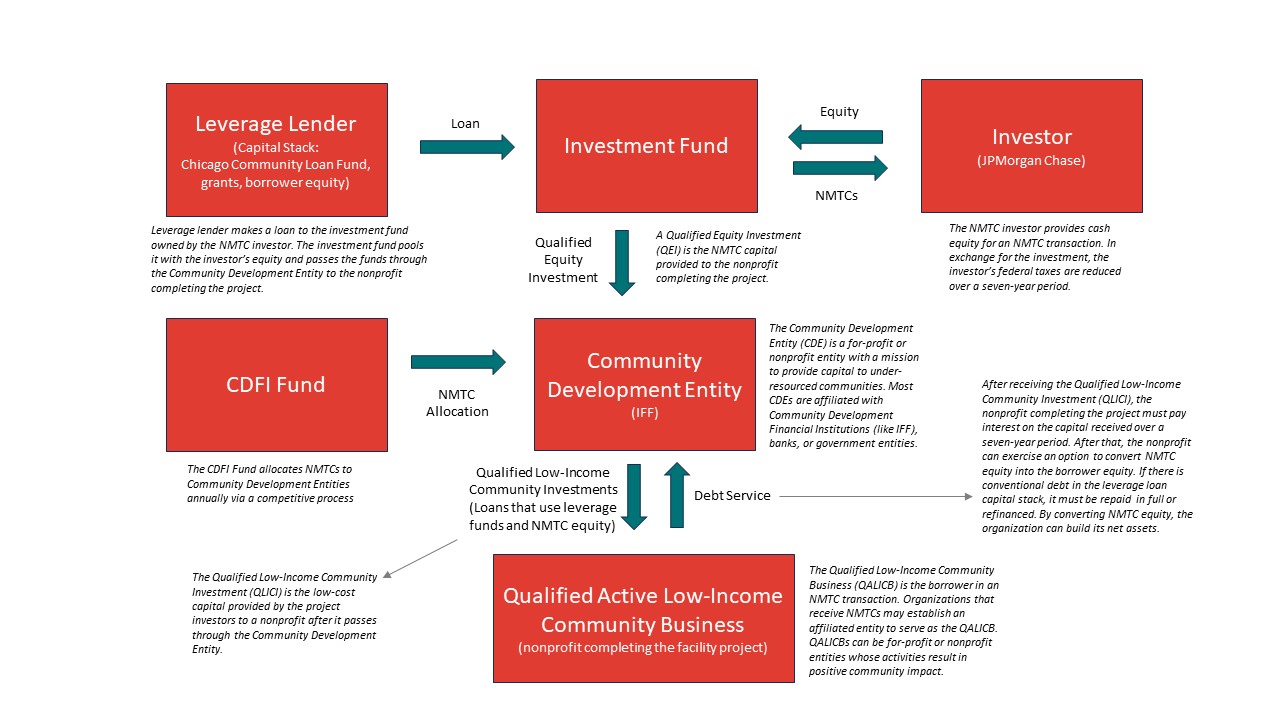

Before diving into an example transaction, it’s important to understand the fundamentals of NMTC deals. Toward that end, the chart below provides a visual representation of the parties involved in a leveraged NMTC transaction and the role each party plays.

A leveraged transaction is one in which a lender provides capital to supplement the equity provided by the NMTC investor to cover the cost of the project. NMTC investors receive 39 percent of the NMTC Qualified Equity Investment in tax credits and provide equity to the project based on the market pricing on a dollar of tax credits ($0.70-$0.85). In a leveraged deal, the equity from the NMTC investor and the financing from a leverage lender are combined and put into an investor-owned fund before flowing to the Community Development Entity.

Here’s what that looks like (a full glossary of NMTC terms is included in the next section as a supplement to chart annotations):

With that in mind, let’s walk through the steps in a hypothetical $10 million leveraged NMTC transaction facilitated by IFF as the Community Development Entity (using the chart above for a visualization of the process):

- The CDFI Fund allocates NMTCs to IFF (as a Community Development Entity).

- In return for NMTCs that will reduce the investor’s federal tax burden, the investor (JPMorgan Chase) provides a $3.3 million equity investment that flows into an investment fund owned by the investor.

- The leverage lender (combined funds from Chicago Community Loan Fund, government grants and borrower equity), provides a $6.3 million loan that flows into the investment fund owned by JPMorgan Chase.

- The investment fund makes a $10 million Qualified Equity Investment (QEI) in the Community Development Entity administered by IFF.

- In turn, the Community Development Entity administered by IFF provides the nonprofit completing the project (i.e., the Qualified Active Low-Income Community Business) with $9.3 million in low-cost capital (i.e., the Qualified Low-Income Community Investment), withholding $700,000 for fees.

- The nonprofit completes its facility project using the capital provided by IFF as the Community Development Entity, and then makes monthly payments on the $9.3 million it borrowed that is passed through IFF as the Community Development Entity to the investment fund.

- From the investment fund, the leverage lender’s loan is repaid over a seven-year period with interest. In return for its equity investment in the Community Development Entity administered by IFF, JPMorgan Chase receives a 39 percent credit against federal taxes – $3.9 million – spread out over seven years.

- At the end of the seven-year period, the nonprofit (i.e., QALICB) typically converts the NMTC equity investment into equity for the organization for a nominal fee, thus helping the nonprofit build its net assets.

Glossary of Terms

The NMTC program is filled with jargon, and we’ve included a basic glossary of terms below to make the content as accessible as possible.

The midpoint of an area’s income distribution, with half of the households in the area earning more than the AMI and half earning less than the AMI. Used to determine eligible communities/census tracts for NMTC allocations.

A department of the U.S. Treasury, the CDFI Fund’s mission is to expand economic opportunity for underserved people and communities by supporting the growth and capacity of a national network of community development lenders, investors, and financial service providers. The NMTC program is administered by the CDFI Fund, which allocates tax credits to “Community Development Entities” (see definition below) via an annual competitive process.

CDEs can be for-profit or nonprofit entities with a primary mission to provide capital to under-resourced communities. CDEs are allocated NMTCs by the CDFI Fund via a competitive application process that’s completed each year and serves as the intermediary for the provision of NMTCs to those applying for them to finance projects. Most CDEs are affiliated with Community Development Financial Institutions (like IFF), banks, or government entities. CDEs are allocated NMTCs based on their track record of serving “disadvantaged businesses and communities” and their plans for using the NMTC allocation to generate community impact in census tracts eligible for NMTCs to be used (see “distressed community” below). In effect, CDEs serve as the lender for NMTCs.

Provides financing for an NMTC-supported project that’s combined with an NMTC investor’s equity to provide the capital needed to complete the project. The financing from the leverage lender(s) is put into an investor-owned fund as debt, enabling the investor to retain 99.99% ownership of the fund. The organization may fill this role, though financial institutions can also serve as the leverage lender.

A community in which the poverty rate is at least 20% or an area where the median family income (AMI) doesn’t exceed 80% of the statewide or metropolitan AMI, depending on the community’s location.

The NMTC investor provides the capital in a NMTC transaction by investing in a CDE or sub-CDE that has been allocated tax credits. In exchange, the investor’s federal taxes are reduced over a seven-year period. NMTC investors in NMTC transactions are typically banking institutions with Community Reinvestment Act obligations.

The borrower in a NMTC transaction. Organizations that receive NMTCs usually establish an affiliated entity to serve as the QALICB. QALICBs can be for-profit or nonprofit entities, with the primary qualification being that the QALICB’s activities result in positive community impact.

The capital put into the NMTC transaction by the tax credit and leverage loan investors.

The capital provided to the organization completing the project (QALICB) by the CDE.

A community in which the poverty rate exceeds 30%; area median family income doesn’t exceed 60% of the state or metropolitan area, depending on where the community is located; unemployment rate at least 1.5 times greater than the national average. There are additional criteria that can classify a community as “severely distressed,” but the criteria above are more commonly used.

Provides a loan to the sponsor organization completing the project or its affiliate, which then uses the capital to make a leverage loan to the investment fund.

A subsidiary of a CDE. Sub-CDEs may be established for individual NMTC-supported projects, with the investor and CDE sharing ownership of the entity.

New Markets Tax Credits in Action: Enhancing Midwest Nonprofits’ Capacity and Impact

As a Community Development Entity, IFF has supported dozens of nonprofits across the Midwest by providing NMTCs for facilities projects. Click the tiles below to read about a handful of those projects and how NMTCs were leveraged to help each organization achieve its facilities goals:

For questions or additional information about New Markets Tax Credits, please contact IFF’s Capital Solutions team.