A blog by IFF CEO Joe Neri

Aligning capital with justice is the north star for Community Development Financial Institutions (CDFIs). We are in the social impact business – whether the route is loans to early education providers, micro-loans to entrepreneurs of color, appraisal gap second mortgages for first-time homebuyers, or construction loans for affordable housing. But, we also need to cover our costs.

Impact investors are in the same boat – striving for impact while also looking for financial returns.

While the alignment between impact investors and CDFIs is well documented, there has been much less discussion about how impact investors should structure their investments in CDFIs. We always need investments that allow us to finance more loans in more places, but – if properly structured – those investments can also strengthen the entire community finance ecosystem and, in turn, create greater impact in even more communities.

Why Partner

In addition to our strong alignment on both community impact and financial returns, CDFIs also provide: diversified portfolios on strong balance sheets, which mitigate risk; expertise to underwrite, close, disburse and service investments in a broad range of sectors and markets; and impact-centered reports on outputs and outcomes.

But there are two additional benefits of the exchange that more deeply support the outcomes desired by both CDFIs and impact investors – and more broadly benefit the community finance ecosystem:

- Leverage of multiple investments into myriad projects and sectors. This benefit is particularly important to impact investors that provide smaller investments and want bigger community impact.

- Identification and cultivation of impactful, investable projects. In my article Exploring the Continuum, I explain that capital alone does not create ‘investable’ projects. CDFIs must work across a continuum of activities – not just raising and deploying capital –to remove significant barriers to investment so that communities are ready to absorb capital. This work is particularly crucial to addressing the decades of underinvestment in communities of color, smaller cities, and rural areas. Impact investors benefit from this work, and it is, in fact, this service that distinguishes CDFIs from other financial intermediaries and wealth managers. We refer to this work as “building a community finance ecosystem,” and it isn’t free (see my colleague Robin Hacke’s article on Capital Absorption for more detail).

CDFIs cannot build the ecosystem alone. We need impact investors – especially community and place-based foundations, health systems, and educational institutions – to understand the importance of building the ecosystem and see the value of building CDFI enterprise strength as part of that system.

So how do impact investors do that? They can start by understanding that the more we can balance the needs of the impact investor with the needs of the CDFI as an enterprise, the more we can create efficiency and effectiveness in that capital reaching and strengthening the communities we most desire to serve. This understanding begins with an examination of how each and every investment term and condition – not just the interest rate – can either build the strength of a CDFI or be neutral.

Understanding CDFI enterprise sustainability

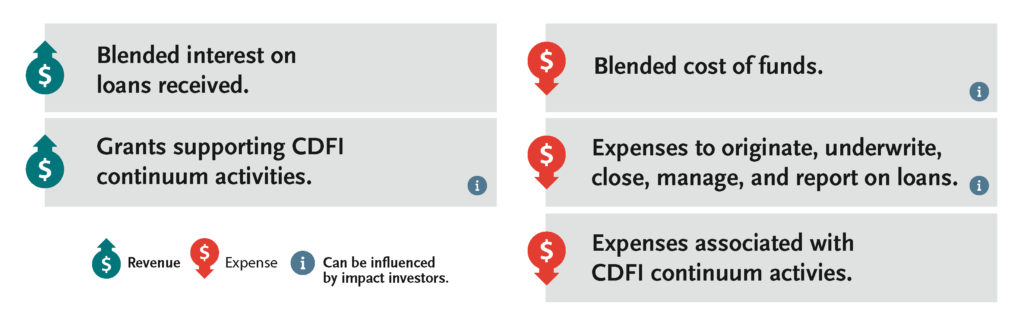

Anyone familiar with the CDFI world understands that no two CDFIs are exactly alike. An old cliché in our industry is that if you know one CDFI, you know one CDFI. Those complexities are real, but, at the most basic level, nearly all CDFI enterprise sustainability is represented by this simple sustainability formula:

All good CDFI managers deeply understand the elements of this formula and seek to manage the inherent tensions they represent. I have purposely separated the expenses for originating, servicing, and reporting on loans from the expenses for conducting Continuum activities to make the very real point that these are separate functions with different costs. A CDFI can greatly reduce expenses by cutting back on the Continuum activities, particularly when faced with a deficit. Of course, that will also reduce its ability to reach the borrowers in most need and weaken the ecosystem –therefore reducing impact. You see the tension.

Most CDFIs fundraise for Continuum activities to cultivate and originate the “investable” community impact projects that impact investors seek. That external fundraising benefits the impact investor as well as the CDFI.

On our terms

Understanding the interplay between the elements of the CDFI sustainability formula and the needs and requirements of impact investors provides insight into how the interest cost, terms, and conditions of their investments can support CDFI strength while delivering on return to the investors. Consider these factors:

- Interest Rate. Providing investments at below-market[1] interest rates is the most direct way that impact investors can strengthen CDFIs. All CDFIs work extremely hard to drive their “cost of funds” down (and their net interest revenues up) by blending their net assets with lower-cost impact investments and more market rate investments. Some of that lower cost is passed on to their borrowers – and thus increases their ability to create positive social impact in their community.

- Subordination. Many impact investors support CDFIs by making subordinated investments – meaning that, in the event of bankruptcy, their investments are only repaid after senior, secured creditors’ (generally commercial financial institutions) claims have been met. While subordinated debt is still debt, the subordination makes many commercial financial institution investors more comfortable with lending to CDFIs, thereby increasing the total capital available to CDFIs. Many of the IFF’s impact investors, particularly faith-based institutions, provide subordinated debt. And although the position is subordinated, in practice, IFF has returned principal and interest to investors 100% of the time in our 33-year track record.

IFF has returned principal and interest to investors 100% of the time in our 33-year track record.

- Term. Longer investment terms, particularly when coupled with below-market rates, strengthen CDFIs in multiple ways. They reduce capital raising expenses and increase the flexibility of CDFI loan products. A 10-year term makes possible significantly different activities than a three- or five-year term. Longer terms are also invaluable for CDFI forecasting, budgeting, and smarter capital planning.

- Timing. Investor flexibility around when they require a CDFI to draw down an investment and start paying interest can significantly reduce or mitigate harmful negative arbitrage – the temporary window of time when the CDFI is paying interest greater than its earnings on loans. This most commonly occurs when an investor requires a CDFI to fully draw upon and begin paying interest on an investment that has use restrictions the CDFI might struggle to meet.

- Use Restrictions. Few investment conditions stress the tensions between impact investors and CDFIs more than restrictions on how the investment may be used, most pointedly: geographic and sector restrictions. Now, before any community or sector-specific foundation immediately scrolls down to the comment section of this blog, CDFIs fully understand your grantmaking mandates about places and sectors. And, they are a challenge to be managed and mitigated. When an investor requests specific geographic or sector restrictions, CDFIs immediately think about how long it will take to lend those dollars in that market and whether that effort will add to their expenses. This harkens back to the sustainability formula: CDFIs make money by lending money, so restrictions that slow or inhibit lending also slow or inhibit revenues. Of course, CDFIs never want to sit on money and never want to disappoint investors. But these are the economic reasons that CDFIs are going to push impact investors, especially community foundations, to expand their geographic restrictions – particularly when they are small. I’m not suggesting that community foundations expand their work beyond their service areas. I am suggesting that there are ways to mitigate the impact of small markets in ways that strengthen CDFIs as partners. I will provide examples of that below.

Few investment conditions stress the tensions between impact investors and CDFIs more than restrictions on how the investment may be used … CDFIs make money by lending money, so restrictions that slow or inhibit lending also slow or inhibit revenues.

- Reporting. Keeping CDFI expenses down is another way of supporting them. The more bespoke the reporting requirements, the greater the expense to provide. It can be the proverbial death by a thousand paper cuts. CDFIs are continuing to increase their ability to efficiently create standard reports that answer most of the questions investors tend have on their investments.

An example: Impact investing that builds CDFI strength

A Program Related Investment (PRI) that The Kresge Foundation made in IFF exemplifies how impact investors and CDFIs can negotiate investment terms that strengthen CDFIs and meet the needs of investors.

In 2013, at the time of Detroit’s bankruptcy, The Kresge Foundation wanted to make an investment in IFF to support our expansion into Detroit and Michigan. Kresge also had a great interest in significantly increasing access to quality early childhood care and education in the city. To align their PRI and early education strategies, Kresge offered IFF a PRI for early education loans in Detroit.

Our work frequently presents a chicken-and-egg problem. While Detroit is a large city, the size of the early education market was tiny, which was why Kresge was creating a sizeable, 10-year, programmatic strategy to increase both access and quality. Kresge understood that it needed a CDFI to conduct the Continuum of activities to build the early education sector’s ability to absorb capital, and there would be a real time-lag before many loans could be made. Kresge and IFF got to work.

To support IFF as a CDFI expanding into Detroit and Michigan, Kresge allowed IFF to use the PRI to make loans broadly to our target market – nonprofits in all sectors and anywhere in Michigan – but asked that 60 percent of the loans be in Detroit. It also asked IFF to make “best efforts” to “prioritize” lending to early education providers.

“Best efforts” language is an excellent mediation tool for thoughtful impact investors.

This example shows an impact investor thinking and working on multiple levels: matching its investing with its grantmaking focus; strengthening the community finance ecosystem that affects its community; supporting and strengthening a CDFI’s ability to respond in the future as part of that ecosystem; understanding that a Continuum of activities is required to build a sector’s/community’s ability to absorb capital; and thinking about short-, medium-, and long-term impact and financial returns.

Of course, The Kresge Foundation is a large institution, and Detroit is a large city. Can smaller impact investors focused on smaller service areas achieve similar results in balancing their needs with the needs of the CDFI? I believe they can.

A smaller community foundation wanting to focus their investments in a smaller service area can do a number of things to mitigate the impact of that smaller area on the CDFI. It could allow the draw down of funds to coincide with the CDFI’s first loan. It could adopt “best efforts” language for the CDFI’s focus, but allow the dollars to be immediately used in other areas. It could make a corresponding grant to be used for deeper marketing and business development in the smaller geography, or for Continuum activities that help develop borrowers. It could actively market and identify prospective borrowers in the community. It can do a combination of these activities, most consistent with the Foundation’s own mission to serve.

Thinking about how CDFIs can work with community foundations and other impact investors in smaller cities and rural communities is an important discussion for a future blog article. But a recent investment in IFF from a smaller community foundation in a small Michigan community exemplifies how to grow CDFI presence in smaller communities.

Rotary Charities of Traverse City is focused on a micropolitan area in northwest Michigan. Rotary was specifically looking for ways that it could make investments that would advance the community development agenda of its 5-county region. It considered making direct investments, but for many of the reasons articulated earlier – particularly risk management – it became interested in how they could partner with IFF to lend. And, of course, IFF was interested in an investment from Rotary and also in lending in northwestern Michigan.

The challenge was how fast IFF could make a loan in the micropolitan community. Rotary was sensitive to IFF’s needs and made a number of decisions to craft an investment that would support IFF, while also making capital available in their community. Rotary allowed its $500,000 investment to be used by IFF to make nonprofit loans anywhere in Michigan, but to “prioritize” lending in Traverse City. If IFF didn’t make a loan in the Traverse City area, it was clear that its investment would not be renewed.

But more importantly, IFF asked Rotary to help IFF find potential borrowers. We are working together to get capital into the community. That collaboration has already created a pipeline of over $4 million of possible loans ($1.7MM already closed) based on that initial $500,000 investment. Rotary is also investing in other CDFIs and efforts for housing and economic development. Even in a rural micropolitan, Rotary is helping to create a community development finance ecosystem.

Exceptional partnerships act as a catalyst for each member to grow and succeed, particularly when each partner takes an active interest in the other’s needs/vulnerabilities, while working together to develop greater shared success.

CDFIs see impact investors as partners in achieving social mission. Impact investors should see CDFIs as their partners in the same. Good partnerships are formed to take advantage of each party’s strengths and resources. Exceptional partnerships act as a catalyst for each member to grow and succeed, particularly when each partner takes an active interest in the other’s needs/vulnerabilities, while working together to develop greater shared success. This is the proverbial work where the whole truly adds up to more than the sum of its parts.

[1] It is important to remember that “Market” rates include investment returns with all types of negative externalities for the environment, public health, the social determinants of health, and racial equity.