A blog by IFF CEO Joe Neri

We are reading a lot about applying a “race equity lens” to community development. So what does it mean to have a race equity lens on capital?

To answer this question, we have to talk about appraisal-based lending – an instrument of systemic racism that still has a profound impact on communities, even after the outlaw of overt redlining more than 50 years ago. IFF has offered non-appraisal-based lending since our founding in 1988 – though I admit it’s not because we were using an explicit race equity lens. We weren’t thinking about it in those terms at that time. Instead, we were using a kind of “nonprofits equity” lens that forced us to deconstruct the challenge of lending to nonprofits that serve lower-income communities.

Last month I introduced my blog with a continuum of activities that CDFIs need to engage in to build a pipeline of “investible” community development projects and to truly reach their goal of aligning capital with justice. Along the continuum are activities that entail a lot of CDFI control, and others that don’t – non-appraisal-based lending is very much within CDFIs’ control, and it’s also central to the ongoing national discussion on racial equity. Let’s discuss how we can use this financial tool as one approach to chipping away at the legacy of racist disinvestment.

The structural racism of appraisal-based lending

The National Housing Act of 1934, which established the Federal Housing Administration (FHA), gave birth to “redlining” – a practice in which banks literally created “residential security” maps with red lines that designated where to avoid making loans. The FHA made it harder to obtain mortgage insurance and federal guarantees in communities of color, so banks avoided working in those communities.

Even though the FHA-driven redlining only applied to home mortgages, appraisers and financial institutions used the maps to set value for all types of lending. Capital became scarcer across the board. And when the supply of capital drops, the price of capital goes up – so communities of color paid higher prices for their capital, thus extracting even more capital from those communities. Scarcity and higher capital prices over a long period deters investment, which deflates price. Values drop.

This vicious circle played out from the 50s thru the 60s and then became illegal after the passage of the Civil Rights Act in 1968. But while banks cannot legally discriminate and draw circles around communities anymore, the legacy of redlining has forever lowered the (appraised) value of land and properties in these areas.[1]

Consider the child care center that wants to construct a new center on donated land in a formerly redlined community. When they apply for a loan, the bank orders an appraisal, which requires “comparables.” Due to long-standing lack of formal market investment, the comps (if any) and land values are very low.

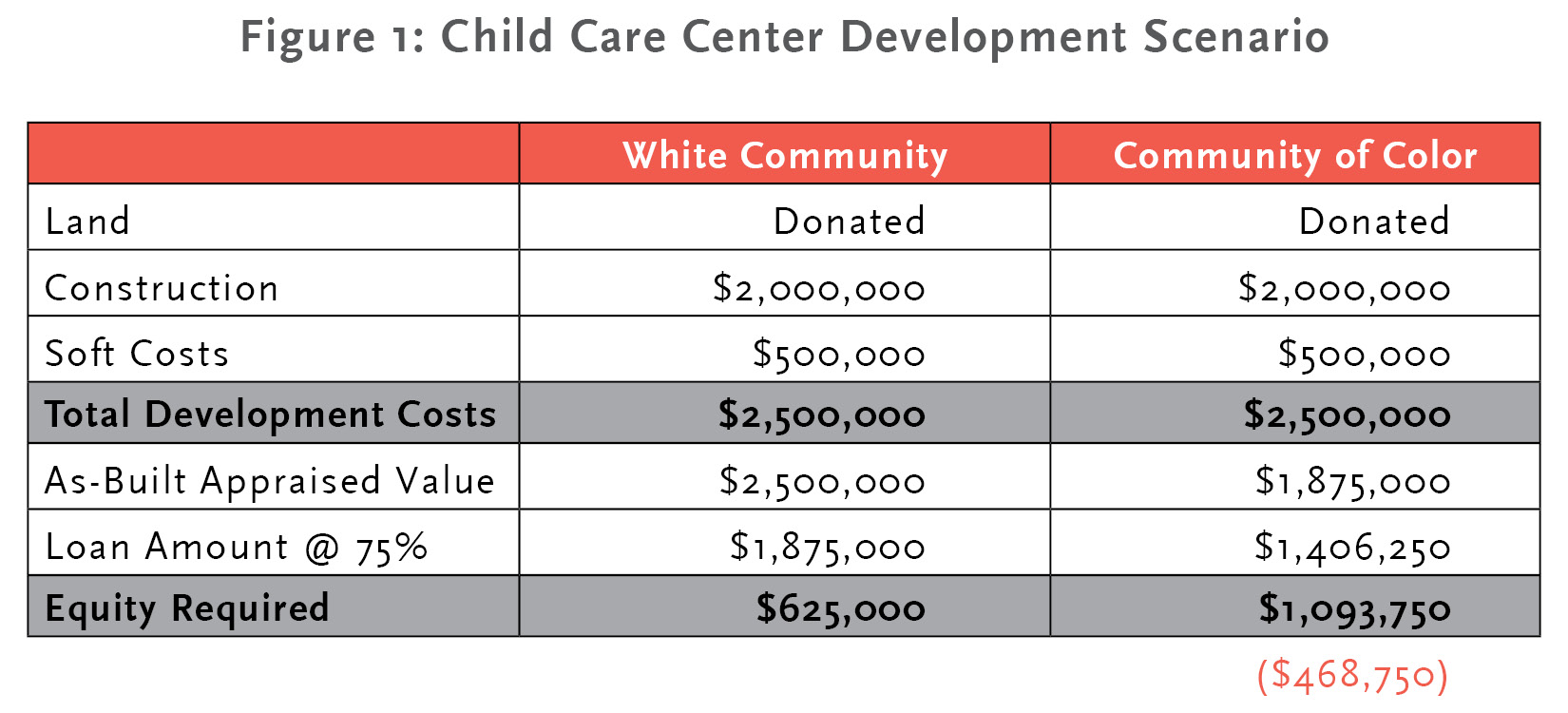

Simply put: Old bank regulations (redlining) drove down the property/land value for decades, and now current bank regulations prevent investment in those areas where appraised-values are low. The bank might still make a loan – but for a 75% loan-to-value ratio where the determined “value” is unjustly low. Construction costs will be the same, but the as-built value will be lower, forcing a lower loan amount (see Figure 1).

No nonprofit should have to raise more money to serve kids in communities of color than they would have to raise to serve kids in white communities.

This isn’t a 1956 scenario; this is a 2019 scenario. The historical legal racism of redlining creates economic and legacy externalities of devaluation. While outright discrimination is outlawed, past practices have been encoded into policies and regulations – such as risk-based pricing and appraisals. Legal or not, the outcome is the same – capital is not reaching communities of color as much as it should.

Appraisals and nonprofits

IFF’s target borrowers are nonprofits serving low-income communities. In 1988, this was the reality that our emerging organization faced: Nonprofit agencies trying to change their communities by providing human services, education, health care and affordable housing could only do that if they could access capital (the very purpose of CDFIs). That capital would, among other things, allow them to purchase the facilities they needed to achieve their missions.

Instead of purchasing, they leased. They improved buildings they did not own. They paid property taxes through their for-profit landlords. And then they were still often forced to move out because of rent increases, or because deferred maintenance threatened their clients and staff.

Owning their own property could relieve a lot of the pressure these nonprofits were under to maintain their brand, control their destiny, and save valuable money that could be put toward their missions. The problem was that banks wouldn’t lend to small and mid-sized nonprofits – and/or wouldn’t lend in the low-income communities where they worked.

Conventional lending is filtered through an appraisal lens that makes it harder and more expensive for nonprofits serving lower-income communities to access affordable debt. (Sound familiar?)

When IFF entered the scene, we knew we had to design products around the needs of nonprofits – and none of those products had greater intensity, weight, and success than our non-appraisal based lending. We did not use an explicit race equity lens in determining that appraisal-based lending was causing systemic injustice; but in deconstructing the challenges that faced our target market – nonprofits serving lower-income communities – we knew that we had to construct a different underwriting and approval regimen. We had to create a new “credit box” that did not allow appraisals to determine the value of the invaluable.

How IFF hacked the appraisal system

I’m the first to admit IFF doesn’t know everything; but one thing that IFF fundamentally understands is that if we adopt the standard of using appraisals to determine our loan amounts, we would make very few loans in the communities we were founded to serve. You can’t build a CDFI by saying “no” to all your clients creating justice.

IFF focused on the logic of appraisals to hack an alternative way of lending on nonprofit facilities. Appraisals are comprised of three approaches for determining “value:”

- Comparables, which we know gets us nowhere. There are few comps for single-purpose facilities like child care centers or schools, and using comps in communities that have been historically under-valued due to the legacy of redlining simply perpetuates the systemic racism that redlining created in the first place.

- Replacement costs, which also get us nowhere. It’s not hard to figure out the cost to re-construct a facility, but no appraiser fixes the value of commercial loans on replacement value alone. And of course, that facility must be built on land that is valued based on the comparables above.

- Income-based approach, which is the approach IFF takes. Instead of asking about the value of the property, IFF asks whether the property is suitable for the nonprofit’s needs and whether the nonprofit can afford the loan payments on our flexible debt. What are the revenues and expenses of the nonprofit, and what is the debt coverage ratio of the proposed project? Yes, IFF is an enterprise cash flow lender on real estate. We are obsessed with understanding revenue projections, government contracting and public policy, fund raising experience and financial management, board governance and management – all the things that tell us how we will get paid back over the 15-year length of our loans.

Now, I’m definitely not saying that IFF’s income-based approach is perfect. Indeed, some of the very criteria I just listed need to be further deconstructed to make sure that past biases are not preventing all of our communities from accessing capital. That’s something we’re in constant dialogue about within our office and amongst our colleagues in the CDFI space.

The point here isn’t that IFF has figured out how to solve for racial equity. Of course we haven’t. But we do think that if we remove the barriers that “appraised value” lending has on our communities, we could move the needle toward greater justice. My questions to you – the readers and leaders in the CDFI+ space – are this:

- Do you think you could make loans without appraisals?

- If not, why?

- If so, what approach would you use to underwrite the loans?

- Are there other lending barriers based in racist disinvestment that can be hacked? Would that increase pipeline?

My friend Nancy Andrews stated in her acceptance speech for Ned Gramlich Lifetime Achievement Award: “We will not invest our way out of racism, or misogyny. We need to put race, gender and justice at the heart of everything we do. That will mean doing more than swimming in our lane, side by side with our civil rights colleagues. It means new partnerships, new priorities, a different lens for understanding our work, and a different kind of focus on public policy than we’ve had in the past.”[2]

I couldn’t agree more. Let’s partner today by discussing how best to put a race equity lens on capital. How can we keep moving this needle together?

###

The purpose of this blog series is to introduce a continuum of activities that CDFIs need to conduct in order for us to better align capital with justice. We know that raising capital alone is not enough to overcome the many barriers that inhibit the flow of capital to lower-income communities.

[1] For a much deeper dive into the history of residential segregation and redlining and how they shaped our modern neighborhoods, see The Color of Law A Forgotten History of How Our Government Segregated America

By Richard Rothstein; How Redlining’s Racist Effects Lasted for Decades, Emily Badger New York Times, Aug. 24, 2017; and The Racist Housing Policy That Made Your Neighborhood, Alexis C. Madrigal, May 22, 2014

[2] Andrews, Nancy O., 2017. “A Hole in Our Vision: Race, Gender and Justice in Community Development,” Community Development Investment Review, Federal Reserve Bank of San Francisco, issue 1, pages 011-014.